AMPER, SA and Subsidiaries Consolidated Financial Statements for ...

AMPER, SA and Subsidiaries Consolidated Financial Statements for ...

AMPER, SA and Subsidiaries Consolidated Financial Statements for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

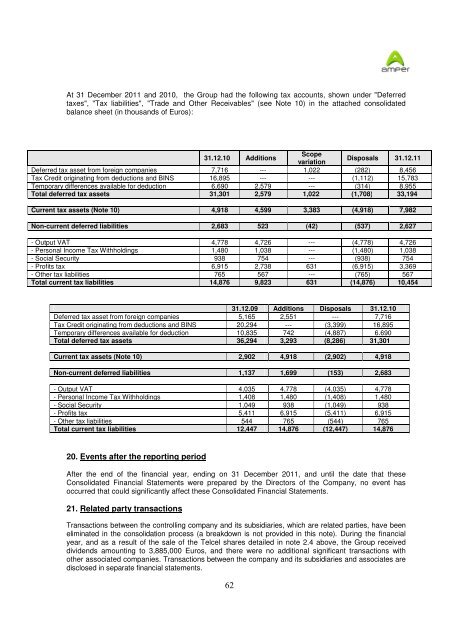

At 31 December 2011 <strong>and</strong> 2010, the Group had the following tax accounts, shown under "Deferred<br />

taxes", "Tax liabilities", "Trade <strong>and</strong> Other Receivables" (see Note 10) in the attached consolidated<br />

balance sheet (in thous<strong>and</strong>s of Euros):<br />

31.12.10 Additions<br />

Scope<br />

variation<br />

Disposals 31.12.11<br />

Deferred tax asset from <strong>for</strong>eign companies 7,716 --- 1,022 (282) 8,456<br />

Tax Credit originating from deductions <strong>and</strong> BINS 16,895 --- --- (1,112) 15,783<br />

Temporary differences available <strong>for</strong> deduction 6,690 2,579 --- (314) 8,955<br />

Total deferred tax assets 31,301 2,579 1,022 (1,708) 33,194<br />

Current tax assets (Note 10) 4,918 4,599 3,383 (4,918) 7,982<br />

Non-current deferred liabilities 2,683 523 (42) (537) 2,627<br />

- Output VAT 4,778 4,726 --- (4,778) 4,726<br />

- Personal Income Tax Withholdings 1,480 1,038 --- (1,480) 1,038<br />

- Social Security 938 754 --- (938) 754<br />

- Profits tax 6,915 2,738 631 (6,915) 3,369<br />

- Other tax liabilities 765 567 --- (765) 567<br />

Total current tax liabilities 14,876 9,823 631 (14,876) 10,454<br />

31.12.09 Additions Disposals 31.12.10<br />

Deferred tax asset from <strong>for</strong>eign companies 5,165 2,551 --- 7,716<br />

Tax Credit originating from deductions <strong>and</strong> BINS 20,294 --- (3,399) 16,895<br />

Temporary differences available <strong>for</strong> deduction 10,835 742 (4,887) 6.690<br />

Total deferred tax assets 36,294 3,293 (8,286) 31,301<br />

Current tax assets (Note 10) 2,902 4,918 (2,902) 4,918<br />

Non-current deferred liabilities 1,137 1,699 (153) 2,683<br />

- Output VAT 4,035 4,778 (4,035) 4,778<br />

- Personal Income Tax Withholdings 1,408 1,480 (1,408) 1,480<br />

- Social Security 1,049 938 (1,049) 938<br />

- Profits tax 5,411 6,915 (5,411) 6,915<br />

- Other tax liabilities 544 765 (544) 765<br />

Total current tax liabilities 12,447 14,876 (12,447) 14,876<br />

20. Events after the reporting period<br />

After the end of the financial year, ending on 31 December 2011, <strong>and</strong> until the date that these<br />

<strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> were prepared by the Directors of the Company, no event has<br />

occurred that could significantly affect these <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong>.<br />

21. Related party transactions<br />

Transactions between the controlling company <strong>and</strong> its subsidiaries, which are related parties, have been<br />

eliminated in the consolidation process (a breakdown is not provided in this note). During the financial<br />

year, <strong>and</strong> as a result of the sale of the Telcel shares detailed in note 2.4 above, the Group received<br />

dividends amounting to 3,885,000 Euros, <strong>and</strong> there were no additional significant transactions with<br />

other associated companies. Transactions between the company <strong>and</strong> its subsidiaries <strong>and</strong> associates are<br />

disclosed in separate financial statements.<br />

62