Exchange Rate Economics: Theories and Evidence

Exchange Rate Economics: Theories and Evidence

Exchange Rate Economics: Theories and Evidence

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

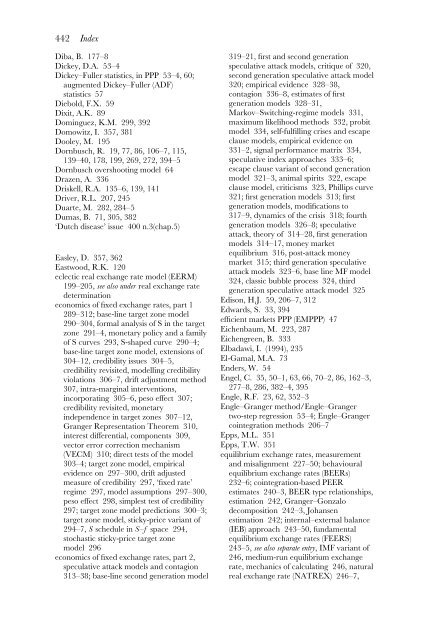

442 Index<br />

Diba,B. 177–8<br />

Dickey,D.A. 53–4<br />

Dickey–Fuller statistics,in PPP 53–4,60;<br />

augmented Dickey–Fuller (ADF)<br />

statistics 57<br />

Diebold,F.X. 59<br />

Dixit,A.K. 89<br />

Dominguez,K.M. 299,392<br />

Domowitz,I. 357,381<br />

Dooley,M. 195<br />

Dornbusch,R. 19,77,86,106–7,115,<br />

139–40,178,199,269,272,394–5<br />

Dornbusch overshooting model 64<br />

Drazen,A. 336<br />

Driskell,R.A. 135–6,139,141<br />

Driver,R.L. 207,245<br />

Duarte,M. 282,284–5<br />

Dumas,B. 71,305,382<br />

‘Dutch disease’ issue 400 n.3(chap.5)<br />

Easley,D. 357,362<br />

Eastwood,R.K. 120<br />

eclectic real exchange rate model (EERM)<br />

199–205, see also under real exchange rate<br />

determination<br />

economics of fixed exchange rates,part 1<br />

289–312; base-line target zone model<br />

290–304,formal analysis of S in the target<br />

zone 291–4,monetary policy <strong>and</strong> a family<br />

of S curves 293,S-shaped curve 290–4;<br />

base-line target zone model,extensions of<br />

304–12,credibility issues 304–5,<br />

credibility revisited,modelling credibility<br />

violations 306–7,drift adjustment method<br />

307,intra-marginal interventions,<br />

incorporating 305–6,peso effect 307;<br />

credibility revisited,monetary<br />

independence in target zones 307–12,<br />

Granger Representation Theorem 310,<br />

interest differential,components 309,<br />

vector error correction mechanism<br />

(VECM) 310; direct tests of the model<br />

303–4; target zone model,empirical<br />

evidence on 297–300,drift adjusted<br />

measure of credibility 297,‘fixed rate’<br />

regime 297,model assumptions 297–300,<br />

peso effect 298,simplest test of credibility<br />

297; target zone model predictions 300–3;<br />

target zone model,sticky-price variant of<br />

294–7, S schedule in S–f space 294,<br />

stochastic sticky-price target zone<br />

model 296<br />

economics of fixed exchange rates,part 2,<br />

speculative attack models <strong>and</strong> contagion<br />

313–38; base-line second generation model<br />

319–21,first <strong>and</strong> second generation<br />

speculative attack models,critique of 320,<br />

second generation speculative attack model<br />

320; empirical evidence 328–38,<br />

contagion 336–8,estimates of first<br />

generation models 328–31,<br />

Markov–Switching-regime models 331,<br />

maximum likelihood methods 332,probit<br />

model 334,self-fulfilling crises <strong>and</strong> escape<br />

clause models,empirical evidence on<br />

331–2,signal performance matrix 334,<br />

speculative index approaches 333–6;<br />

escape clause variant of second generation<br />

model 321–3,animal spirits 322,escape<br />

clause model,criticisms 323,Phillips curve<br />

321; first generation models 313; first<br />

generation models,modifications to<br />

317–9,dynamics of the crisis 318; fourth<br />

generation models 326–8; speculative<br />

attack,theory of 314–28,first generation<br />

models 314–17,money market<br />

equilibrium 316,post-attack money<br />

market 315; third generation speculative<br />

attack models 323–6,base line MF model<br />

324,classic bubble process 324,third<br />

generation speculative attack model 325<br />

Edison,H.J. 59,206–7,312<br />

Edwards,S. 33,394<br />

efficient markets PPP (EMPPP) 47<br />

Eichenbaum,M. 223,287<br />

Eichengreen,B. 333<br />

Elbadawi,I. (1994),235<br />

El-Gamal,M.A. 73<br />

Enders,W. 54<br />

Engel,C. 35,50–1,63,66,70–2,86,162–3,<br />

277–8,286,382–4,395<br />

Engle,R.F. 23,62,352–3<br />

Engle–Granger method/Engle–Granger<br />

two-step regression 53–4; Engle–Granger<br />

cointegration methods 206–7<br />

Epps,M.L. 351<br />

Epps,T.W. 351<br />

equilibrium exchange rates,measurement<br />

<strong>and</strong> misalignment 227–50; behavioural<br />

equilibrium exchange rates (BEERs)<br />

232–6; cointegration-based PEER<br />

estimates 240–3,BEER type relationships,<br />

estimation 242,Granger–Gonzalo<br />

decomposition 242–3,Johansen<br />

estimation 242; internal–external balance<br />

(IEB) approach 243–50,fundamental<br />

equilibrium exchange rates (FEERS)<br />

243–5, see also separate entry,IMF variant of<br />

246,medium-run equilibrium exchange<br />

rate,mechanics of calculating 246,natural<br />

real exchange rate (NATREX) 246–7,