Financial Sector Development in Africa: Opportunities ... - World Bank

Financial Sector Development in Africa: Opportunities ... - World Bank

Financial Sector Development in Africa: Opportunities ... - World Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

14 Jarotschk<strong>in</strong><br />

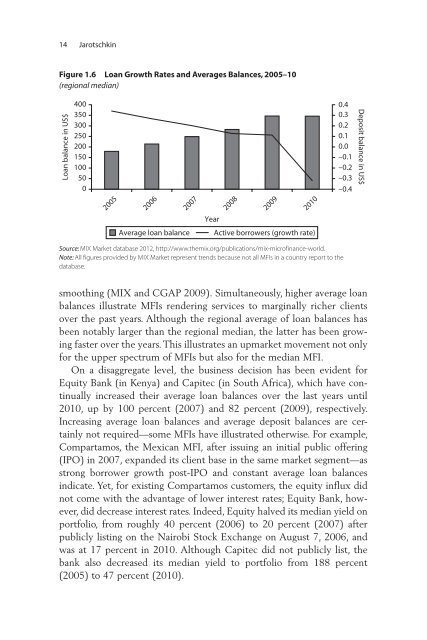

Figure 1.6 Loan Growth Rates and Averages Balances, 2005–10<br />

(regional median)<br />

Loan balance <strong>in</strong> US$<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0.0<br />

–0.1<br />

–0.2<br />

–0.3<br />

–0.4<br />

Deposit balance <strong>in</strong> US$<br />

Year<br />

Average loan balance<br />

Active borrowers (growth rate)<br />

Source: MIX Market database 2012, http://www.themix.org/publications/mix-microf<strong>in</strong>ance-world.<br />

Note: All figures provided by MIX Market represent trends because not all MFIs <strong>in</strong> a country report to the<br />

database.<br />

smooth<strong>in</strong>g (MIX and CGAP 2009). Simultaneously, higher average loan<br />

balances illustrate MFIs render<strong>in</strong>g services to marg<strong>in</strong>ally richer clients<br />

over the past years. Although the regional average of loan balances has<br />

been notably larger than the regional median, the latter has been grow<strong>in</strong>g<br />

faster over the years. This illustrates an upmarket movement not only<br />

for the upper spectrum of MFIs but also for the median MFI.<br />

On a disaggregate level, the bus<strong>in</strong>ess decision has been evident for<br />

Equity <strong>Bank</strong> (<strong>in</strong> Kenya) and Capitec (<strong>in</strong> South <strong>Africa</strong>), which have cont<strong>in</strong>ually<br />

<strong>in</strong>creased their average loan balances over the last years until<br />

2010, up by 100 percent (2007) and 82 percent (2009), respectively.<br />

Increas<strong>in</strong>g average loan balances and average deposit balances are certa<strong>in</strong>ly<br />

not required—some MFIs have illustrated otherwise. For example,<br />

Compartamos, the Mexican MFI, after issu<strong>in</strong>g an <strong>in</strong>itial public offer<strong>in</strong>g<br />

(IPO) <strong>in</strong> 2007, expanded its client base <strong>in</strong> the same market segment—as<br />

strong borrower growth post-IPO and constant average loan balances<br />

<strong>in</strong>dicate. Yet, for exist<strong>in</strong>g Compartamos customers, the equity <strong>in</strong>flux did<br />

not come with the advantage of lower <strong>in</strong>terest rates; Equity <strong>Bank</strong>, however,<br />

did decrease <strong>in</strong>terest rates. Indeed, Equity halved its median yield on<br />

portfolio, from roughly 40 percent (2006) to 20 percent (2007) after<br />

publicly list<strong>in</strong>g on the Nairobi Stock Exchange on August 7, 2006, and<br />

was at 17 percent <strong>in</strong> 2010. Although Capitec did not publicly list, the<br />

bank also decreased its median yield to portfolio from 188 percent<br />

(2005) to 47 percent (2010).