Financial Sector Development in Africa: Opportunities ... - World Bank

Financial Sector Development in Africa: Opportunities ... - World Bank

Financial Sector Development in Africa: Opportunities ... - World Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Microf<strong>in</strong>ance <strong>in</strong> <strong>Africa</strong> 31<br />

<strong>F<strong>in</strong>ancial</strong> <strong>in</strong>frastructure: A necessity. Concerns about credit quality<br />

erosion have become very real for <strong>Africa</strong>, as the 2011 Banana Sk<strong>in</strong>s<br />

report (CSFI 2011) illustrates. Although only at the back of the m<strong>in</strong>d <strong>in</strong><br />

previous surveys, credit risk now ranks as the number one concern worldwide,<br />

<strong>in</strong>clud<strong>in</strong>g <strong>in</strong> <strong>Africa</strong>. Dur<strong>in</strong>g the f<strong>in</strong>ancial crisis, low repayment<br />

might have been fueled ma<strong>in</strong>ly by the dire economic situation of borrowers,<br />

along with unsusta<strong>in</strong>able competition and the lack of credit <strong>in</strong>formation<br />

(MIX and CGAP 2009). In the absence of available <strong>in</strong>formation<br />

through credit bureaus and rat<strong>in</strong>g agencies and the “weakness of <strong>in</strong>ternal<br />

controls of MFIs,” <strong>in</strong>stitutions oversupplied the same market segments<br />

and gave out loans to customers who were already over<strong>in</strong>debted (CSFI<br />

2011). Moses Ochieng, CGAP/DFID regional representative, fears that<br />

over<strong>in</strong>debtedness might lead to the “implosion of some of the key players”<br />

<strong>in</strong> Southern and East <strong>Africa</strong>.<br />

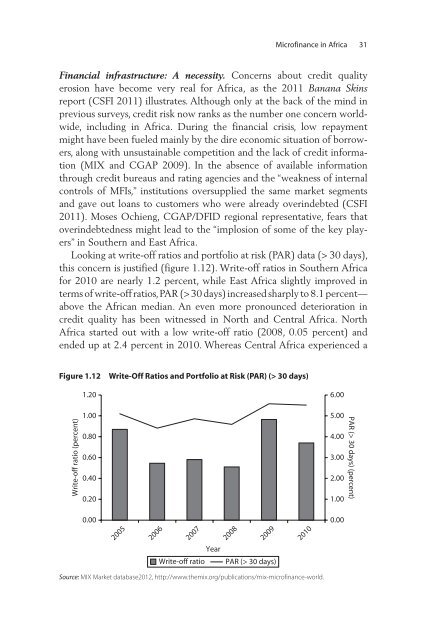

Look<strong>in</strong>g at write-off ratios and portfolio at risk (PAR) data (> 30 days),<br />

this concern is justified (figure 1.12). Write-off ratios <strong>in</strong> Southern <strong>Africa</strong><br />

for 2010 are nearly 1.2 percent, while East <strong>Africa</strong> slightly improved <strong>in</strong><br />

terms of write-off ratios, PAR (> 30 days) <strong>in</strong>creased sharply to 8.1 percent—<br />

above the <strong>Africa</strong>n median. An even more pronounced deterioration <strong>in</strong><br />

credit quality has been witnessed <strong>in</strong> North and Central <strong>Africa</strong>. North<br />

<strong>Africa</strong> started out with a low write-off ratio (2008, 0.05 percent) and<br />

ended up at 2.4 percent <strong>in</strong> 2010. Whereas Central <strong>Africa</strong> experienced a<br />

Figure 1.12<br />

Write-Off Ratios and Portfolio at Risk (PAR) (> 30 days)<br />

1.20<br />

6.00<br />

Write-off ratio (percent)<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

0.20<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

PAR (> 30 days) (percent)<br />

0.00<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

0.00<br />

Year<br />

Write-off ratio<br />

PAR (> 30 days)<br />

Source: MIX Market database2012, http://www.themix.org/publications/mix-microf<strong>in</strong>ance-world.