Financial Sector Development in Africa: Opportunities ... - World Bank

Financial Sector Development in Africa: Opportunities ... - World Bank

Financial Sector Development in Africa: Opportunities ... - World Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28 Jarotschk<strong>in</strong><br />

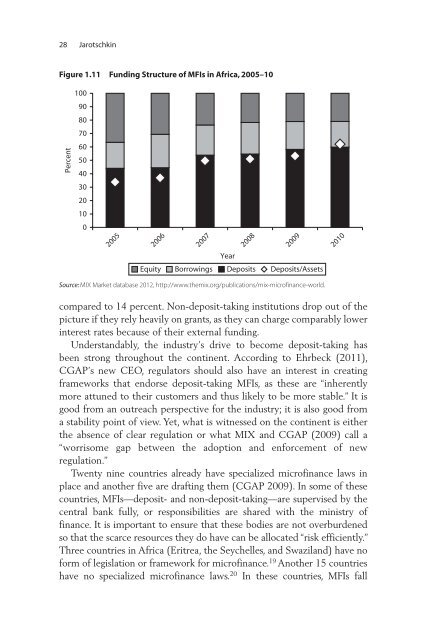

Figure 1.11 Fund<strong>in</strong>g Structure of MFIs <strong>in</strong> <strong>Africa</strong>, 2005–10<br />

Percent<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

Year<br />

Equity Borrow<strong>in</strong>gs Deposits Deposits/Assets<br />

Source: MIX Market database 2012, http://www.themix.org/publications/mix-microf<strong>in</strong>ance-world.<br />

compared to 14 percent. Non-deposit-tak<strong>in</strong>g <strong>in</strong>stitutions drop out of the<br />

picture if they rely heavily on grants, as they can charge comparably lower<br />

<strong>in</strong>terest rates because of their external fund<strong>in</strong>g.<br />

Understandably, the <strong>in</strong>dustry’s drive to become deposit-tak<strong>in</strong>g has<br />

been strong throughout the cont<strong>in</strong>ent. Accord<strong>in</strong>g to Ehrbeck (2011),<br />

CGAP’s new CEO, regulators should also have an <strong>in</strong>terest <strong>in</strong> creat<strong>in</strong>g<br />

frameworks that endorse deposit-tak<strong>in</strong>g MFIs, as these are “<strong>in</strong>herently<br />

more attuned to their customers and thus likely to be more stable.” It is<br />

good from an outreach perspective for the <strong>in</strong>dustry; it is also good from<br />

a stability po<strong>in</strong>t of view. Yet, what is witnessed on the cont<strong>in</strong>ent is either<br />

the absence of clear regulation or what MIX and CGAP (2009) call a<br />

“worrisome gap between the adoption and enforcement of new<br />

regulation.”<br />

Twenty n<strong>in</strong>e countries already have specialized microf<strong>in</strong>ance laws <strong>in</strong><br />

place and another five are draft<strong>in</strong>g them (CGAP 2009). In some of these<br />

countries, MFIs—deposit- and non-deposit-tak<strong>in</strong>g—are supervised by the<br />

central bank fully, or responsibilities are shared with the m<strong>in</strong>istry of<br />

f<strong>in</strong>ance. It is important to ensure that these bodies are not overburdened<br />

so that the scarce resources they do have can be allocated “risk efficiently.”<br />

Three countries <strong>in</strong> <strong>Africa</strong> (Eritrea, the Seychelles, and Swaziland) have no<br />

form of legislation or framework for microf<strong>in</strong>ance. 19 Another 15 countries<br />

have no specialized microf<strong>in</strong>ance laws. 20 In these countries, MFIs fall