Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

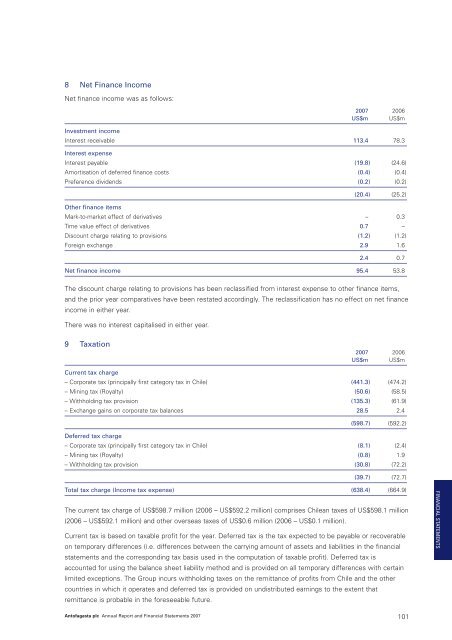

8 Net Finance IncomeNet finance income was as follows:<strong>2007</strong> 2006US$m US$mInvestment incomeInterest receivable 113.4 78.3Interest expenseInterest payable (19.8) (24.6)Amortisation of deferred finance costs (0.4) (0.4)Preference dividends (0.2) (0.2)(20.4) (25.2)Other finance itemsMark-to-market effect of derivatives – 0.3Time value effect of derivatives 0.7 –Discount charge relating to provisions (1.2) (1.2)Foreign exchange 2.9 1.62.4 0.7Net finance income 95.4 53.8The discount charge relating to provisions has been reclassified from interest expense to other finance items,and the prior year comparatives have been restated accordingly. The reclassification has no effect on net financeincome in either year.There was no interest capitalised in either year.9 Taxation<strong>2007</strong> 2006US$m US$mCurrent tax charge– Corporate tax (principally first category tax in Chile) (441.3) (474.2)– Mining tax (Royalty) (50.6) (58.5)– Withholding tax provision (135.3) (61.9)– Exchange gains on corporate tax balances 28.5 2.4(598.7) (592.2)Deferred tax charge– Corporate tax (principally first category tax in Chile) (8.1) (2.4)– Mining tax (Royalty) (0.8) 1.9– Withholding tax provision (30.8) (72.2)(39.7) (72.7)Total tax charge (Income tax expense) (638.4) (664.9)The current tax charge of US$598.7 million (2006 – US$592.2 million) comprises Chilean taxes of US$598.1 million(2006 – US$592.1 million) and other overseas taxes of US$0.6 million (2006 – US$0.1 million).Current tax is based on taxable profit for the year. Deferred tax is the tax expected to be payable or recoverableon temporary differences (i.e. differences between the carrying amount of assets and liabilities in the financialstatements and the corresponding tax basis used in the computation of taxable profit). Deferred tax isaccounted for using the balance sheet liability method and is provided on all temporary differences with certainlimited exceptions. The Group incurs withholding taxes on the remittance of profits from Chile and the othercountries in which it operates and deferred tax is provided on undistributed earnings to the extent thatremittance is probable in the foreseeable future.FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 101