Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

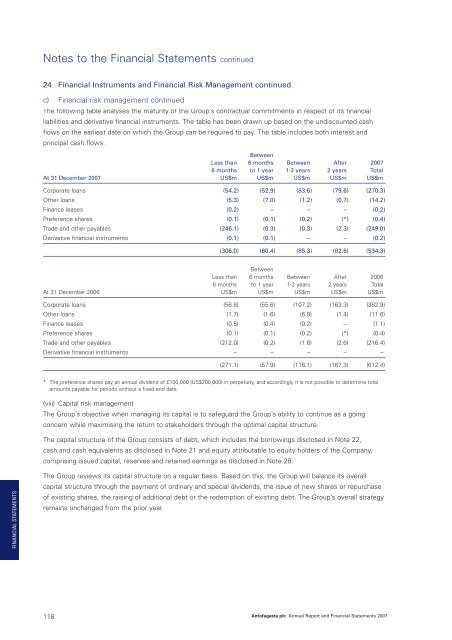

Notes to the Financial Statements continued24 Financial Instruments and Financial Risk Management continuedc) Financial risk management continuedThe following table analyses the maturity of the Group’s contractual commitments in respect of its financialliabilities and derivative financial instruments. The table has been drawn up based on the undiscounted cashflows on the earliest date on which the Group can be required to pay. The table includes both interest andprincipal cash flows.BetweenLess than 6 months Between After <strong>2007</strong>6 months to 1 year 1-2 years 2 years TotalAt 31 December <strong>2007</strong> US$m US$m US$m US$m US$mCorporate loans (54.2) (52.9) (83.6) (79.6) (270.3)Other loans (5.3) (7.0) (1.2) (0.7) (14.2)Finance leases (0.2) – – – (0.2)Preference shares (0.1) (0.1) (0.2) (*) (0.4)Trade and other payables (246.1) (0.3) (0.3) (2.3) (249.0)Derivative financial instruments (0.1) (0.1) – – (0.2)(306.0) (60.4) (85.3) (82.6) (534.3)BetweenLess than 6 months Between After 20066 months to 1 year 1-2 years 2 years TotalAt 31 December 2006 US$m US$m US$m US$m US$mCorporate loans (56.8) (55.6) (107.2) (163.3) (382.9)Other loans (1.7) (1.6) (6.9) (1.4) (11.6)Finance leases (0.5) (0.4) (0.2) – (1.1)Preference shares (0.1) (0.1) (0.2) (*) (0.4)Trade and other payables (212.0) (0.2) (1.6) (2.6) (216.4)Derivative financial instruments – – – – –(271.1) (57.9) (116.1) (167.3) (612.4)* The preference shares pay an annual dividend of £100,000 (US$200,000) in perpetuity, and accordingly it is not possible to determine totalamounts payable for periods without a fixed end date.(viii) Capital risk managementThe Group’s objective when managing its capital is to safeguard the Group’s ability to continue as a goingconcern while maximising the return to stakeholders through the optimal capital structure.The capital structure of the Group consists of debt, which includes the borrowings disclosed in Note 22,cash and cash equivalents as disclosed in Note 21 and equity attributable to equity holders of the Company,comprising issued capital, reserves and retained earnings as disclosed in Note 28.FINANCIAL STATEMENTSThe Group reviews its capital structure on a regular basis. Based on this, the Group will balance its overallcapital structure through the payment of ordinary and special dividends, the issue of new shares or repurchaseof existing shares, the raising of additional debt or the redemption of existing debt. The Group’s overall strategyremains unchanged from the prior year.118<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>