Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

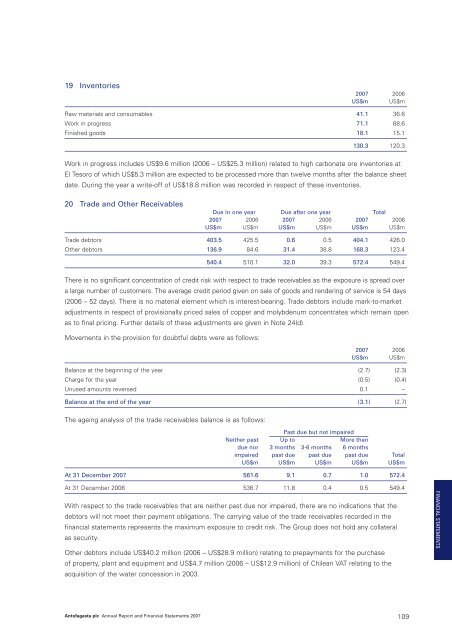

19 Inventories<strong>2007</strong> 2006US$m US$mRaw materials and consumables 41.1 36.6Work in progress 71.1 68.6Finished goods 18.1 15.1130.3 120.3Work in progress includes US$9.6 million (2006 – US$25.3 million) related to high carbonate ore inventories atEl Tesoro of which US$5.3 million are expected to be processed more than twelve months after the balance sheetdate. During the year a write-off of US$18.8 million was recorded in respect of these inventories.20 Trade and Other ReceivablesDue in one year Due after one year Total<strong>2007</strong> 2006 <strong>2007</strong> 2006 <strong>2007</strong> 2006US$m US$m US$m US$m US$m US$mTrade debtors 403.5 425.5 0.6 0.5 404.1 426.0Other debtors 136.9 84.6 31.4 38.8 168.3 123.4540.4 510.1 32.0 39.3 572.4 549.4There is no significant concentration of credit risk with respect to trade receivables as the exposure is spread overa large number of customers. The average credit period given on sale of goods and rendering of service is 54 days(2006 – 52 days). There is no material element which is interest-bearing. Trade debtors include mark-to-marketadjustments in respect of provisionally priced sales of copper and molybdenum concentrates which remain openas to final pricing. Further details of these adjustments are given in Note 24(d).Movements in the provision for doubtful debts were as follows:<strong>2007</strong> 2006US$m US$mBalance at the beginning of the year (2.7) (2.3)Charge for the year (0.5) (0.4)Unused amounts reversed 0.1 –Balance at the end of the year (3.1) (2.7)The ageing analysis of the trade receivables balance is as follows:Past due but not impairedNeither past Up to More thandue nor 3 months 3-6 months 6 monthsimpaired past due past due past due TotalUS$m US$m US$m US$m US$mAt 31 December <strong>2007</strong> 561.6 9.1 0.7 1.0 572.4At 31 December 2006 536.7 11.8 0.4 0.5 549.4With respect to the trade receivables that are neither past due nor impaired, there are no indications that thedebtors will not meet their payment obligations. The carrying value of the trade receivables recorded in thefinancial statements represents the maximum exposure to credit risk. The Group does not hold any collateralas security.Other debtors include US$40.2 million (2006 – US$28.9 million) relating to prepayments for the purchaseof property, plant and equipment and US$4.7 million (2006 – US$12.9 million) of Chilean VAT relating to theacquisition of the water concession in 2003.FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 109