Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

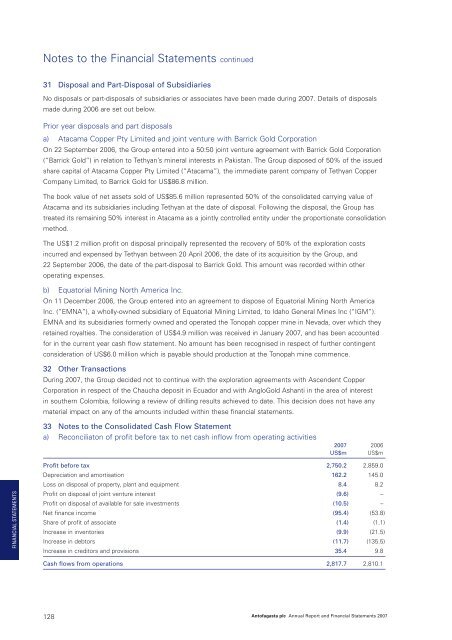

Notes to the Financial Statements continued31 Disposal and Part-Disposal of SubsidiariesNo disposals or part-disposals of subsidiaries or associates have been made during <strong>2007</strong>. Details of disposalsmade during 2006 are set out below.Prior year disposals and part disposalsa) Atacama Copper Pty Limited and joint venture with Barrick Gold CorporationOn 22 September 2006, the Group entered into a 50:50 joint venture agreement with Barrick Gold Corporation(“Barrick Gold”) in relation to Tethyan’s mineral interests in Pakistan. The Group disposed of 50% of the issuedshare capital of Atacama Copper Pty Limited (“Atacama”), the immediate parent company of Tethyan CopperCompany Limited, to Barrick Gold for US$86.8 million.The book value of net assets sold of US$85.6 million represented 50% of the consolidated carrying value ofAtacama and its subsidiaries including Tethyan at the date of disposal. Following the disposal, the Group hastreated its remaining 50% interest in Atacama as a jointly controlled entity under the proportionate consolidationmethod.The US$1.2 million profit on disposal principally represented the recovery of 50% of the exploration costsincurred and expensed by Tethyan between 20 April 2006, the date of its acquisition by the Group, and22 September 2006, the date of the part-disposal to Barrick Gold. This amount was recorded within otheroperating expenses.b) Equatorial Mining North America Inc.On 11 December 2006, the Group entered into an agreement to dispose of Equatorial Mining North AmericaInc. (“EMNA”), a wholly-owned subsidiary of Equatorial Mining Limited, to Idaho General Mines Inc (“IGM”).EMNA and its subsidiaries formerly owned and operated the Tonopah copper mine in Nevada, over which theyretained royalties. The consideration of US$4.9 million was received in January <strong>2007</strong>, and has been accountedfor in the current year cash flow statement. No amount has been recognised in respect of further contingentconsideration of US$6.0 million which is payable should production at the Tonopah mine commence.32 Other TransactionsDuring <strong>2007</strong>, the Group decided not to continue with the exploration agreements with Ascendent CopperCorporation in respect of the Chaucha deposit in Ecuador and with AngloGold Ashanti in the area of interestin southern Colombia, following a review of drilling results achieved to date. This decision does not have anymaterial impact on any of the amounts included within these financial statements.33 Notes to the Consolidated Cash Flow Statementa) Reconciliaton of profit before tax to net cash inflow from operating activities<strong>2007</strong> 2006US$m US$mFINANCIAL STATEMENTSProfit before tax 2,750.2 2,859.0Depreciation and amortisation 162.2 145.0Loss on disposal of property, plant and equipment 8.4 8.2Profit on disposal of joint venture interest (9.6) –Profit on disposal of available for sale investments (10.5) –Net finance income (95.4) (53.8)Share of profit of associate (1.4) (1.1)Increase in inventories (9.9) (21.5)Increase in debtors (11.7) (135.5)Increase in creditors and provisions 35.4 9.8Cash flows from operations 2,817.7 2,810.1128<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>