Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

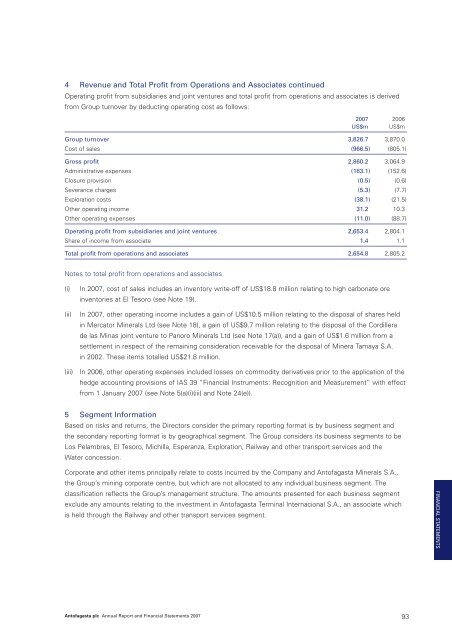

4 Revenue and Total Profit from Operations and Associates continuedOperating profit from subsidiaries and joint ventures and total profit from operations and associates is derivedfrom Group turnover by deducting operating cost as follows:<strong>2007</strong> 2006US$m US$mGroup turnover 3,826.7 3,870.0Cost of sales (966.5) (805.1)Gross profit 2,860.2 3,064.9Administrative expenses (183.1) (152.6)Closure provision (0.5) (0.6)Severance charges (5.3) (7.7)Exploration costs (38.1) (21.5)Other operating income 31.2 10.3Other operating expenses (11.0) (88.7)Operating profit from subsidiaries and joint ventures 2,653.4 2,804.1Share of income from associate 1.4 1.1Total profit from operations and associates 2,654.8 2,805.2Notes to total profit from operations and associates(i)(ii)In <strong>2007</strong>, cost of sales includes an inventory write-off of US$18.8 million relating to high carbonate oreinventories at El Tesoro (see Note 19).In <strong>2007</strong>, other operating income includes a gain of US$10.5 million relating to the disposal of shares heldin Mercator Minerals Ltd (see Note 18), a gain of US$9.7 million relating to the disposal of the Cordillerade las Minas joint venture to Panoro Minerals Ltd (see Note 17(a)), and a gain of US$1.6 million from asettlement in respect of the remaining consideration receivable for the disposal of Minera Tamaya S.A.in 2002. These items totalled US$21.8 million.(iii) In 2006, other operating expenses included losses on commodity derivatives prior to the application of thehedge accounting provisions of IAS 39 “Financial Instruments: Recognition and Measurement” with effectfrom 1 January <strong>2007</strong> (see Note 5(a)(i)(iii) and Note 24(e)).5 Segment InformationBased on risks and returns, the Directors consider the primary reporting format is by business segment andthe secondary reporting format is by geographical segment. The Group considers its business segments to beLos Pelambres, El Tesoro, Michilla, Esperanza, Exploration, Railway and other transport services and theWater concession.Corporate and other items principally relate to costs incurred by the Company and <strong>Antofagasta</strong> Minerals S.A.,the Group’s mining corporate centre, but which are not allocated to any individual business segment. Theclassification reflects the Group’s management structure. The amounts presented for each business segmentexclude any amounts relating to the investment in <strong>Antofagasta</strong> Terminal Internacional S.A., an associate whichis held through the Railway and other transport services segment.FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 93