Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

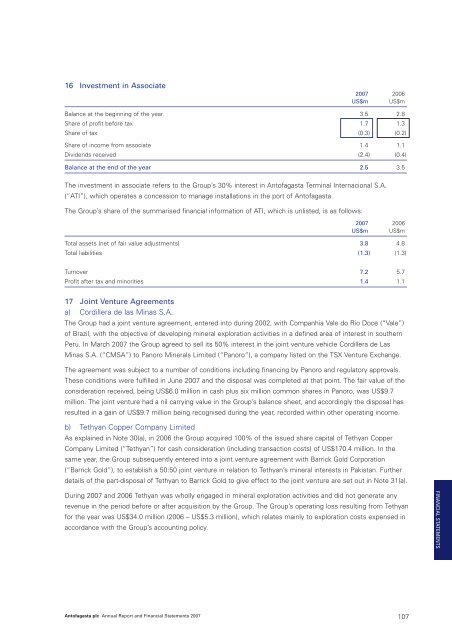

16 Investment in Associate<strong>2007</strong> 2006US$m US$mBalance at the beginning of the year 3.5 2.8Share of profit before tax 1.7 1.3Share of tax (0.3) (0.2)Share of income from associate 1.4 1.1Dividends received (2.4) (0.4)Balance at the end of the year 2.5 3.5The investment in associate refers to the Group’s 30% interest in <strong>Antofagasta</strong> Terminal Internacional S.A.(“ATI”), which operates a concession to manage installations in the port of <strong>Antofagasta</strong>.The Group’s share of the summarised financial information of ATI, which is unlisted, is as follows:<strong>2007</strong> 2006US$m US$mTotal assets (net of fair value adjustments) 3.8 4.8Total liabilities (1.3) (1.3)Turnover 7.2 5.7Profit after tax and minorities 1.4 1.117 Joint Venture Agreementsa) Cordillera de las Minas S.A.The Group had a joint venture agreement, entered into during 2002, with Companhia Vale do Rio Doce (“Vale”)of Brazil, with the objective of developing mineral exploration activities in a defined area of interest in southernPeru. In March <strong>2007</strong> the Group agreed to sell its 50% interest in the joint venture vehicle Cordillera de LasMinas S.A. (“CMSA”) to Panoro Minerals Limited (“Panoro”), a company listed on the TSX Venture Exchange.The agreement was subject to a number of conditions including financing by Panoro and regulatory approvals.These conditions were fulfilled in June <strong>2007</strong> and the disposal was completed at that point. The fair value of theconsideration received, being US$6.0 million in cash plus six million common shares in Panoro, was US$9.7million. The joint venture had a nil carrying value in the Group’s balance sheet, and accordingly the disposal hasresulted in a gain of US$9.7 million being recognised during the year, recorded within other operating income.b) Tethyan Copper Company LimitedAs explained in Note 30(a), in 2006 the Group acquired 100% of the issued share capital of Tethyan CopperCompany Limited (“Tethyan”) for cash consideration (including transaction costs) of US$170.4 million. In thesame year, the Group subsequently entered into a joint venture agreement with Barrick Gold Corporation(“Barrick Gold”), to establish a 50:50 joint venture in relation to Tethyan’s mineral interests in Pakistan. Furtherdetails of the part-disposal of Tethyan to Barrick Gold to give effect to the joint venture are set out in Note 31(a).During <strong>2007</strong> and 2006 Tethyan was wholly engaged in mineral exploration activities and did not generate anyrevenue in the period before or after acquisition by the Group. The Group’s operating loss resulting from Tethyanfor the year was US$34.0 million (2006 – US$5.3 million), which relates mainly to exploration costs expensed inaccordance with the Group’s accounting policy.FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 107