Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

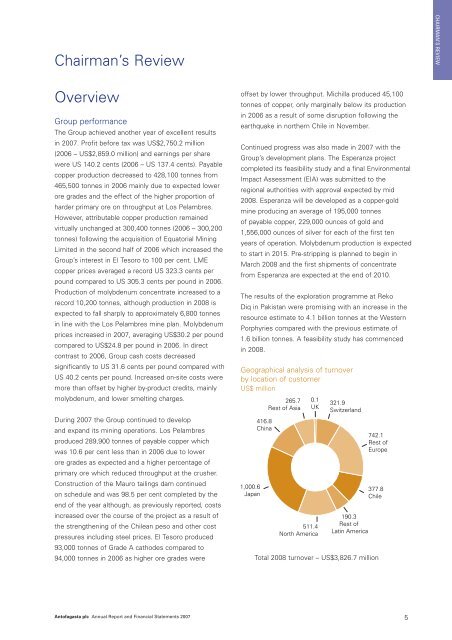

Chairman’s ReviewCHAIRMAN’S REVIEWOverviewGroup performanceThe Group achieved another year of excellent resultsin <strong>2007</strong>. Profit before tax was US$2,750.2 million(2006 – US$2,859.0 million) and earnings per sharewere US 140.2 cents (2006 – US 137.4 cents). Payablecopper production decreased to 428,100 tonnes from465,500 tonnes in 2006 mainly due to expected lowerore grades and the effect of the higher proportion ofharder primary ore on throughput at Los Pelambres.However, attributable copper production remainedvirtually unchanged at 300,400 tonnes (2006 – 300,200tonnes) following the acquisition of Equatorial MiningLimited in the second half of 2006 which increased theGroup’s interest in El Tesoro to 100 per cent. LMEcopper prices averaged a record US 323.3 cents perpound compared to US 305.3 cents per pound in 2006.Production of molybdenum concentrate increased to arecord 10,200 tonnes, although production in 2008 isexpected to fall sharply to approximately 6,800 tonnesin line with the Los Pelambres mine plan. Molybdenumprices increased in <strong>2007</strong>, averaging US$30.2 per poundcompared to US$24.8 per pound in 2006. In directcontrast to 2006, Group cash costs decreasedsignificantly to US 31.6 cents per pound compared withUS 40.2 cents per pound. Increased on-site costs weremore than offset by higher by-product credits, mainlymolybdenum, and lower smelting charges.During <strong>2007</strong> the Group continued to developand expand its mining operations. Los Pelambresproduced 289,900 tonnes of payable copper whichwas 10.6 per cent less than in 2006 due to lowerore grades as expected and a higher percentage ofprimary ore which reduced throughput at the crusher.Construction of the Mauro tailings dam continuedon schedule and was 98.5 per cent completed by theend of the year although, as previously reported, costsincreased over the course of the project as a result ofthe strengthening of the Chilean peso and other costpressures including steel prices. El Tesoro produced93,000 tonnes of Grade A cathodes compared to94,000 tonnes in 2006 as higher ore grades wereoffset by lower throughput. Michilla produced 45,100tonnes of copper, only marginally below its productionin 2006 as a result of some disruption following theearthquake in northern Chile in November.Continued progress was also made in <strong>2007</strong> with theGroup’s development plans. The Esperanza projectcompleted its feasibility study and a final EnvironmentalImpact Assessment (EIA) was submitted to theregional authorities with approval expected by mid2008. Esperanza will be developed as a copper-goldmine producing an average of 195,000 tonnesof payable copper, 229,000 ounces of gold and1,556,000 ounces of silver for each of the first tenyears of operation. Molybdenum production is expectedto start in 2015. Pre-stripping is planned to begin inMarch 2008 and the first shipments of concentratefrom Esperanza are expected at the end of 2010.The results of the exploration programme at RekoDiq in Pakistan were promising with an increase in theresource estimate to 4.1 billion tonnes at the WesternPorphyries compared with the previous estimate of1.6 billion tonnes. A feasibility study has commencedin 2008.Geographical analysis of turnoverby location of customerUS$ million1,000.6Japan416.8China265.7Rest of Asia0.1UK511.4North America321.9Switzerland190.3Rest ofLatin America742.1Rest ofEurope377.8ChileTotal 2008 turnover – US$3,826.7 million<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 5