Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

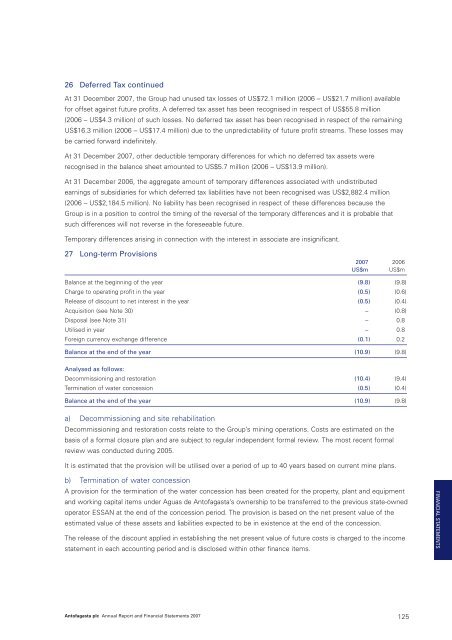

26 Deferred Tax continuedAt 31 December <strong>2007</strong>, the Group had unused tax losses of US$72.1 million (2006 – US$21.7 million) availablefor offset against future profits. A deferred tax asset has been recognised in respect of US$55.8 million(2006 – US$4.3 million) of such losses. No deferred tax asset has been recognised in respect of the remainingUS$16.3 million (2006 – US$17.4 million) due to the unpredictability of future profit streams. These losses maybe carried forward indefinitely.At 31 December <strong>2007</strong>, other deductible temporary differences for which no deferred tax assets wererecognised in the balance sheet amounted to US$5.7 million (2006 – US$13.9 million).At 31 December 2006, the aggregate amount of temporary differences associated with undistributedearnings of subsidiaries for which deferred tax liabilities have not been recognised was US$2,882.4 million(2006 – US$2,184.5 million). No liability has been recognised in respect of these differences because theGroup is in a position to control the timing of the reversal of the temporary differences and it is probable thatsuch differences will not reverse in the foreseeable future.Temporary differences arising in connection with the interest in associate are insignificant.27 Long-term Provisions<strong>2007</strong> 2006US$m US$mBalance at the beginning of the year (9.8) (9.8)Charge to operating profit in the year (0.5) (0.6)Release of discount to net interest in the year (0.5) (0.4)Acquisition (see Note 30) – (0.8)Disposal (see Note 31) – 0.8Utilised in year – 0.8Foreign currency exchange difference (0.1) 0.2Balance at the end of the year (10.9) (9.8)Analysed as follows:Decommissioning and restoration (10.4) (9.4)Termination of water concession (0.5) (0.4)Balance at the end of the year (10.9) (9.8)a) Decommissioning and site rehabilitationDecommissioning and restoration costs relate to the Group’s mining operations. Costs are estimated on thebasis of a formal closure plan and are subject to regular independent formal review. The most recent formalreview was conducted during 2005.It is estimated that the provision will be utilised over a period of up to 40 years based on current mine plans.b) Termination of water concessionA provision for the termination of the water concession has been created for the property, plant and equipmentand working capital items under Aguas de <strong>Antofagasta</strong>’s ownership to be transferred to the previous state-ownedoperator ESSAN at the end of the concession period. The provision is based on the net present value of theestimated value of these assets and liabilities expected to be in existence at the end of the concession.The release of the discount applied in establishing the net present value of future costs is charged to the incomestatement in each accounting period and is disclosed within other finance items.FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 125