Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

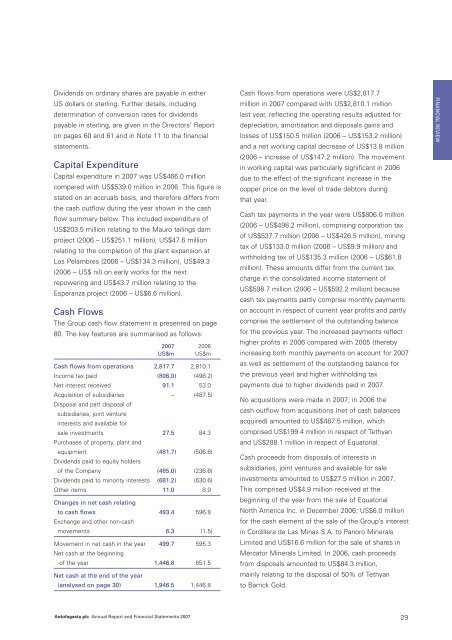

Dividends on ordinary shares are payable in eitherUS dollars or sterling. Further details, includingdetermination of conversion rates for dividendspayable in sterling, are given in the Directors’ <strong>Report</strong>on pages 60 and 61 and in Note 11 to the financialstatements.Capital ExpenditureCapital expenditure in <strong>2007</strong> was US$466.0 millioncompared with US$539.0 million in 2006. This figure isstated on an accruals basis, and therefore differs fromthe cash outflow during the year shown in the cashflow summary below. This included expenditure ofUS$203.5 million relating to the Mauro tailings damproject (2006 – US$251.1 million), US$47.6 millionrelating to the completion of the plant expansion atLos Pelambres (2006 – US$134.3 million), US$49.3(2006 – US$ nil) on early works for the nextrepowering and US$43.7 million relating to theEsperanza project (2006 – US$6.6 million).Cash FlowsThe Group cash flow statement is presented on page80. The key features are summarised as follows:<strong>2007</strong> 2006US$m US$mCash flows from operations 2,817.7 2,810.1Income tax paid (806.0) (498.2)Net interest received 91.1 53.0Acquisition of subsidiaries – (487.5)Disposal and part disposal ofsubsidiaries, joint ventureinterests and available forsale investments 27.5 84.3Purchases of property, plant andequipment (481.7) (506.6)Dividends paid to equity holdersof the Company (485.0) (236.6)Dividends paid to minority interests (681.2) (630.6)Other items 11.0 8.9Changes in net cash relatingto cash flows 493.4 596.8Exchange and other non-cashmovements 6.3 (1.5)Movement in net cash in the year 499.7 595.3Net cash at the beginningof the year 1,446.8 851.5Net cash at the end of the year(analysed on page 30) 1,946.5 1,446.8Cash flows from operations were US$2,817.7million in <strong>2007</strong> compared with US$2,810.1 millionlast year, reflecting the operating results adjusted fordepreciation, amortisation and disposals gains andlosses of US$150.5 million (2006 – US$153.2 million)and a net working capital decrease of US$13.8 million(2006 – increase of US$147.2 million). The movementin working capital was particularly significant in 2006due to the effect of the significant increase in thecopper price on the level of trade debtors duringthat year.Cash tax payments in the year were US$806.0 million(2006 – US$498.2 million), comprising corporation taxof US$537.7 million (2006 – US$426.5 million), miningtax of US$133.0 million (2006 – US$9.9 million) andwithholding tax of US$135.3 million (2006 – US$61.8million). These amounts differ from the current taxcharge in the consolidated income statement ofUS$598.7 million (2006 – US$592.2 million) becausecash tax payments partly comprise monthly paymentson account in respect of current year profits and partlycomprise the settlement of the outstanding balancefor the previous year. The increased payments reflecthigher profits in 2006 compared with 2005 (therebyincreasing both monthly payments on account for <strong>2007</strong>as well as settlement of the outstanding balance forthe previous year) and higher withholding taxpayments due to higher dividends paid in <strong>2007</strong>.No acquisitions were made in <strong>2007</strong>; in 2006 thecash outflow from acquisitions (net of cash balancesacquired) amounted to US$487.5 million, whichcomprised US$199.4 million in respect of Tethyanand US$288.1 million in respect of Equatorial.Cash proceeds from disposals of interests insubsidiaries, joint ventures and available for saleinvestments amounted to US$27.5 million in <strong>2007</strong>.This comprised US$4.9 million received at thebeginning of the year from the sale of EquatorialNorth America Inc. in December 2006; US$6.0 millionfor the cash element of the sale of the Group’s interestin Cordillera de Las Minas S.A. to Panoro MineralsLimited and US$16.6 million for the sale of shares inMercator Minerals Limited. In 2006, cash proceedsfrom disposals amounted to US$84.3 million,mainly relating to the disposal of 50% of Tethyanto Barrick Gold.FINANCIAL REVIEW<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 29