Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

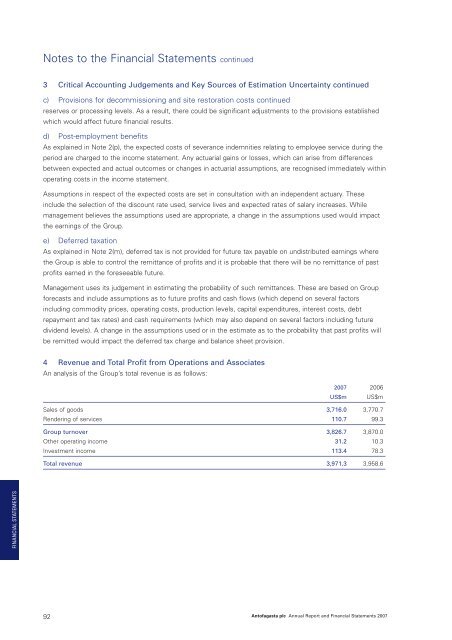

Notes to the Financial Statements continued3 Critical Accounting Judgements and Key Sources of Estimation Uncertainty continuedc) Provisions for decommissioning and site restoration costs continuedreserves or processing levels. As a result, there could be significant adjustments to the provisions establishedwhich would affect future financial results.d) Post-employment benefitsAs explained in Note 2(p), the expected costs of severance indemnities relating to employee service during theperiod are charged to the income statement. Any actuarial gains or losses, which can arise from differencesbetween expected and actual outcomes or changes in actuarial assumptions, are recognised immediately withinoperating costs in the income statement.Assumptions in respect of the expected costs are set in consultation with an independent actuary. Theseinclude the selection of the discount rate used, service lives and expected rates of salary increases. Whilemanagement believes the assumptions used are appropriate, a change in the assumptions used would impactthe earnings of the Group.e) Deferred taxationAs explained in Note 2(m), deferred tax is not provided for future tax payable on undistributed earnings wherethe Group is able to control the remittance of profits and it is probable that there will be no remittance of pastprofits earned in the foreseeable future.Management uses its judgement in estimating the probability of such remittances. These are based on Groupforecasts and include assumptions as to future profits and cash flows (which depend on several factorsincluding commodity prices, operating costs, production levels, capital expenditures, interest costs, debtrepayment and tax rates) and cash requirements (which may also depend on several factors including futuredividend levels). A change in the assumptions used or in the estimate as to the probability that past profits willbe remitted would impact the deferred tax charge and balance sheet provision.4 Revenue and Total Profit from Operations and AssociatesAn analysis of the Group’s total revenue is as follows:<strong>2007</strong> 2006US$m US$mSales of goods 3,716.0 3,770.7Rendering of services 110.7 99.3Group turnover 3,826.7 3,870.0Other operating income 31.2 10.3Investment income 113.4 78.3Total revenue 3,971.3 3,958.6FINANCIAL STATEMENTS92<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>