Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

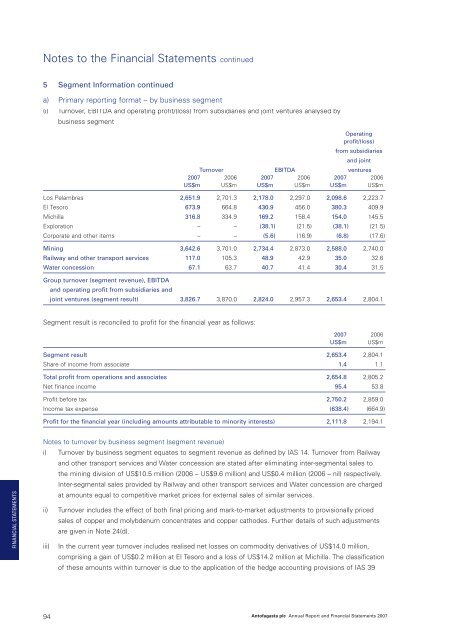

Notes to the Financial Statements continued5 Segment Information continueda) Primary reporting format – by business segment(i)Turnover, EBITDA and operating profit/(loss) from subsidiaries and joint ventures analysed bybusiness segmentOperatingprofit/(loss)from subsidiariesand jointTurnover EBITDA ventures<strong>2007</strong> 2006 <strong>2007</strong> 2006 <strong>2007</strong> 2006US$m US$m US$m US$m US$m US$mLos Pelambres 2,651.9 2,701.3 2,178.0 2,297.0 2,098.6 2,223.7El Tesoro 673.9 664.8 430.9 456.0 380.3 409.9Michilla 316.8 334.9 169.2 158.4 154.0 145.5Exploration – – (38.1) (21.5) (38.1) (21.5)Corporate and other items – – (5.6) (16.9) (6.8) (17.6)Mining 3,642.6 3,701.0 2,734.4 2,873.0 2,588.0 2,740.0Railway and other transport services 117.0 105.3 48.9 42.9 35.0 32.6Water concession 67.1 63.7 40.7 41.4 30.4 31.5Group turnover (segment revenue), EBITDAand operating profit from subsidiaries andjoint ventures (segment result) 3,826.7 3,870.0 2,824.0 2,957.3 2,653.4 2,804.1Segment result is reconciled to profit for the financial year as follows:<strong>2007</strong> 2006US$m US$mSegment result 2,653.4 2,804.1Share of income from associate 1.4 1.1Total profit from operations and associates 2,654.8 2,805.2Net finance income 95.4 53.8Profit before tax 2,750.2 2,859.0Income tax expense (638.4) (664.9)Profit for the financial year (including amounts attributable to minority interests) 2,111.8 2,194.1FINANCIAL STATEMENTSNotes to turnover by business segment (segment revenue)i) Turnover by business segment equates to segment revenue as defined by IAS 14. Turnover from Railwayand other transport services and Water concession are stated after eliminating inter-segmental sales tothe mining division of US$10.5 million (2006 – US$9.6 million) and US$0.4 million (2006 – nil) respectively.Inter-segmental sales provided by Railway and other transport services and Water concession are chargedat amounts equal to competitive market prices for external sales of similar services.ii) Turnover includes the effect of both final pricing and mark-to-market adjustments to provisionally pricedsales of copper and molybdenum concentrates and copper cathodes. Further details of such adjustmentsare given in Note 24(d).iii) In the current year turnover includes realised net losses on commodity derivatives of US$14.0 million,comprising a gain of US$0.2 million at El Tesoro and a loss of US$14.2 million at Michilla. The classificationof these amounts within turnover is due to the application of the hedge accounting provisions of IAS 3994<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>