Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

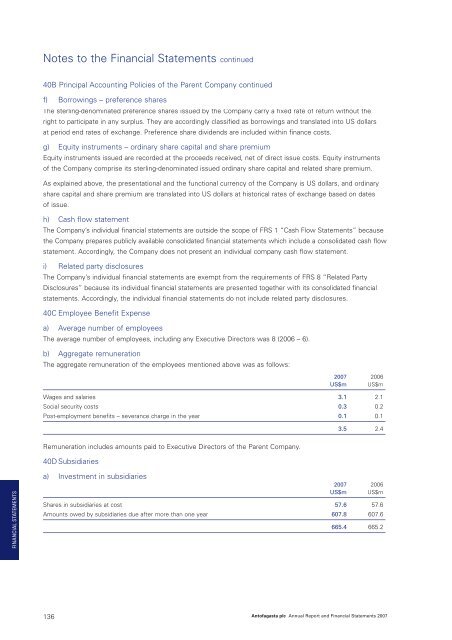

Notes to the Financial Statements continued40B Principal Accounting Policies of the Parent Company continuedf) Borrowings – preference sharesThe sterling-denominated preference shares issued by the Company carry a fixed rate of return without theright to participate in any surplus. They are accordingly classified as borrowings and translated into US dollarsat period end rates of exchange. Preference share dividends are included within finance costs.g) Equity instruments – ordinary share capital and share premiumEquity instruments issued are recorded at the proceeds received, net of direct issue costs. Equity instrumentsof the Company comprise its sterling-denominated issued ordinary share capital and related share premium.As explained above, the presentational and the functional currency of the Company is US dollars, and ordinaryshare capital and share premium are translated into US dollars at historical rates of exchange based on datesof issue.h) Cash flow statementThe Company’s individual financial statements are outside the scope of FRS 1 “Cash Flow Statements” becausethe Company prepares publicly available consolidated financial statements which include a consolidated cash flowstatement. Accordingly, the Company does not present an individual company cash flow statement.i) Related party disclosuresThe Company’s individual financial statements are exempt from the requirements of FRS 8 “Related PartyDisclosures” because its individual financial statements are presented together with its consolidated financialstatements. Accordingly, the individual financial statements do not include related party disclosures.40C Employee Benefit Expensea) Average number of employeesThe average number of employees, including any Executive Directors was 8 (2006 – 6).b) Aggregate remunerationThe aggregate remuneration of the employees mentioned above was as follows:<strong>2007</strong> 2006US$m US$mWages and salaries 3.1 2.1Social security costs 0.3 0.2Post-employment benefits – severance charge in the year 0.1 0.13.5 2.4Remuneration includes amounts paid to Executive Directors of the Parent Company.40D SubsidiariesFINANCIAL STATEMENTSa) Investment in subsidiaries<strong>2007</strong> 2006US$m US$mShares in subsidiaries at cost 57.6 57.6Amounts owed by subsidiaries due after more than one year 607.8 607.6665.4 665.2136<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>