Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

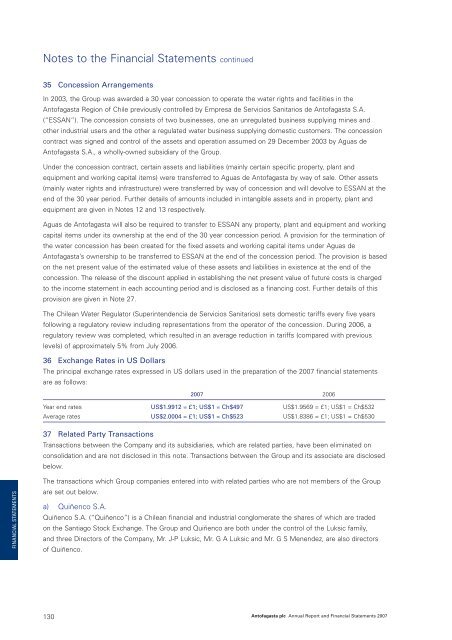

Notes to the Financial Statements continued35 Concession ArrangementsIn 2003, the Group was awarded a 30 year concession to operate the water rights and facilities in the<strong>Antofagasta</strong> Region of Chile previously controlled by Empresa de Servicios Sanitarios de <strong>Antofagasta</strong> S.A.(“ESSAN”). The concession consists of two businesses, one an unregulated business supplying mines andother industrial users and the other a regulated water business supplying domestic customers. The concessioncontract was signed and control of the assets and operation assumed on 29 December 2003 by Aguas de<strong>Antofagasta</strong> S.A., a wholly-owned subsidiary of the Group.Under the concession contract, certain assets and liabilities (mainly certain specific property, plant andequipment and working capital items) were transferred to Aguas de <strong>Antofagasta</strong> by way of sale. Other assets(mainly water rights and infrastructure) were transferred by way of concession and will devolve to ESSAN at theend of the 30 year period. Further details of amounts included in intangible assets and in property, plant andequipment are given in Notes 12 and 13 respectively.Aguas de <strong>Antofagasta</strong> will also be required to transfer to ESSAN any property, plant and equipment and workingcapital items under its ownership at the end of the 30 year concession period. A provision for the termination ofthe water concession has been created for the fixed assets and working capital items under Aguas de<strong>Antofagasta</strong>’s ownership to be transferred to ESSAN at the end of the concession period. The provision is basedon the net present value of the estimated value of these assets and liabilities in existence at the end of theconcession. The release of the discount applied in establishing the net present value of future costs is chargedto the income statement in each accounting period and is disclosed as a financing cost. Further details of thisprovision are given in Note 27.The Chilean Water Regulator (Superintendencia de Servicios Sanitarios) sets domestic tariffs every five yearsfollowing a regulatory review including representations from the operator of the concession. During 2006, aregulatory review was completed, which resulted in an average reduction in tariffs (compared with previouslevels) of approximately 5% from July 2006.36 Exchange Rates in US DollarsThe principal exchange rates expressed in US dollars used in the preparation of the <strong>2007</strong> financial statementsare as follows:<strong>2007</strong> 2006Year end rates US$1.9912 = £1; US$1 = Ch$497 US$1.9569 = £1; US$1 = Ch$532Average rates US$2.0004 = £1; US$1 = Ch$523 US$1.8386 = £1; US$1 = Ch$53037 Related Party TransactionsTransactions between the Company and its subsidiaries, which are related parties, have been eliminated onconsolidation and are not disclosed in this note. Transactions between the Group and its associate are disclosedbelow.FINANCIAL STATEMENTSThe transactions which Group companies entered into with related parties who are not members of the Groupare set out below.a) Quiñenco S.A.Quiñenco S.A. (“Quiñenco”) is a Chilean financial and industrial conglomerate the shares of which are tradedon the Santiago Stock Exchange. The Group and Quiñenco are both under the control of the Luksic family,and three Directors of the Company, Mr. J-P Luksic, Mr. G A Luksic and Mr. G S Menendez, are also directorsof Quiñenco.130<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>