Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

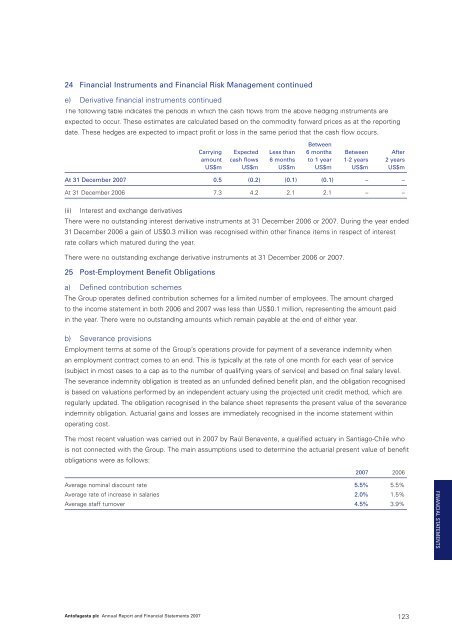

24 Financial Instruments and Financial Risk Management continuede) Derivative financial instruments continuedThe following table indicates the periods in which the cash flows from the above hedging instruments areexpected to occur. These estimates are calculated based on the commodity forward prices as at the reportingdate. These hedges are expected to impact profit or loss in the same period that the cash flow occurs.BetweenCarrying Expected Less than 6 months Between Afteramount cash flows 6 months to 1 year 1-2 years 2 yearsUS$m US$m US$m US$m US$m US$mAt 31 December <strong>2007</strong> 0.5 (0.2) (0.1) (0.1) – –At 31 December 2006 7.3 4.2 2.1 2.1 – –(ii) Interest and exchange derivativesThere were no outstanding interest derivative instruments at 31 December 2006 or <strong>2007</strong>. During the year ended31 December 2006 a gain of US$0.3 million was recognised within other finance items in respect of interestrate collars which matured during the year.There were no outstanding exchange derivative instruments at 31 December 2006 or <strong>2007</strong>.25 Post-Employment Benefit Obligationsa) Defined contribution schemesThe Group operates defined contribution schemes for a limited number of employees. The amount chargedto the income statement in both 2006 and <strong>2007</strong> was less than US$0.1 million, representing the amount paidin the year. There were no outstanding amounts which remain payable at the end of either year.b) Severance provisionsEmployment terms at some of the Group’s operations provide for payment of a severance indemnity whenan employment contract comes to an end. This is typically at the rate of one month for each year of service(subject in most cases to a cap as to the number of qualifying years of service) and based on final salary level.The severance indemnity obligation is treated as an unfunded defined benefit plan, and the obligation recognisedis based on valuations performed by an independent actuary using the projected unit credit method, which areregularly updated. The obligation recognised in the balance sheet represents the present value of the severanceindemnity obligation. Actuarial gains and losses are immediately recognised in the income statement withinoperating cost.The most recent valuation was carried out in <strong>2007</strong> by Raúl Benavente, a qualified actuary in Santiago-Chile whois not connected with the Group. The main assumptions used to determine the actuarial present value of benefitobligations were as follows:<strong>2007</strong> 2006Average nominal discount rate 5.5% 5.5%Average rate of increase in salaries 2.0% 1.5%Average staff turnover 4.5% 3.9%FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 123