Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

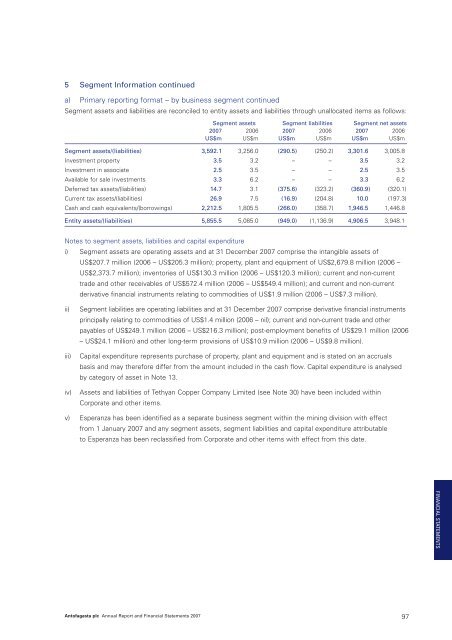

5 Segment Information continueda) Primary reporting format – by business segment continuedSegment assets and liabilities are reconciled to entity assets and liabilities through unallocated items as follows:Segment assets Segment liabilities Segment net assets<strong>2007</strong> 2006 <strong>2007</strong> 2006 <strong>2007</strong> 2006US$m US$m US$m US$m US$m US$mSegment assets/(liabilities) 3,592.1 3,256.0 (290.5) (250.2) 3,301.6 3,005.8Investment property 3.5 3.2 – – 3.5 3.2Investment in associate 2.5 3.5 – – 2.5 3.5Available for sale investments 3.3 6.2 – – 3.3 6.2Deferred tax assets/(liabilities) 14.7 3.1 (375.6) (323.2) (360.9) (320.1)Current tax assets/(liabilities) 26.9 7.5 (16.9) (204.8) 10.0 (197.3)Cash and cash equivalents/(borrowings) 2,212.5 1,805.5 (266.0) (358.7) 1,946.5 1,446.8Entity assets/(liabilities) 5,855.5 5,085.0 (949.0) (1,136.9) 4,906.5 3,948.1Notes to segment assets, liabilities and capital expenditurei) Segment assets are operating assets and at 31 December <strong>2007</strong> comprise the intangible assets ofUS$207.7 million (2006 – US$205.3 million); property, plant and equipment of US$2,679.8 million (2006 –US$2,373.7 million); inventories of US$130.3 million (2006 – US$120.3 million); current and non-currenttrade and other receivables of US$572.4 million (2006 – US$549.4 million); and current and non-currentderivative financial instruments relating to commodities of US$1.9 million (2006 – US$7.3 million).ii)iii)iv)Segment liabilities are operating liabilities and at 31 December <strong>2007</strong> comprise derivative financial instrumentsprincipally relating to commodities of US$1.4 million (2006 – nil); current and non-current trade and otherpayables of US$249.1 million (2006 – US$216.3 million); post-employment benefits of US$29.1 million (2006– US$24.1 million) and other long-term provisions of US$10.9 million (2006 – US$9.8 million).Capital expenditure represents purchase of property, plant and equipment and is stated on an accrualsbasis and may therefore differ from the amount included in the cash flow. Capital expenditure is analysedby category of asset in Note 13.Assets and liabilities of Tethyan Copper Company Limited (see Note 30) have been included withinCorporate and other items.v) Esperanza has been identified as a separate business segment within the mining division with effectfrom 1 January <strong>2007</strong> and any segment assets, segment liabilities and capital expenditure attributableto Esperanza has been reclassified from Corporate and other items with effect from this date.FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 97