Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

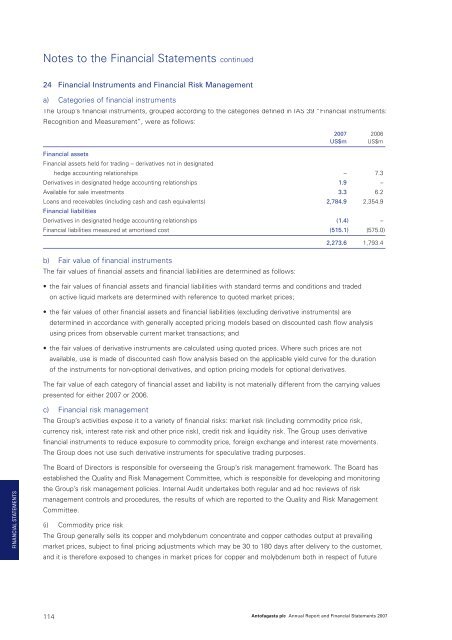

Notes to the Financial Statements continued24 Financial Instruments and Financial Risk Managementa) Categories of financial instrumentsThe Group’s financial instruments, grouped according to the categories defined in IAS 39 “Financial instruments:Recognition and Measurement”, were as follows:<strong>2007</strong> 2006US$m US$mFinancial assetsFinancial assets held for trading – derivatives not in designatedhedge accounting relationships – 7.3Derivatives in designated hedge accounting relationships 1.9 –Available for sale investments 3.3 6.2Loans and receivables (including cash and cash equivalents) 2,784.9 2,354.9Financial liabilitiesDerivatives in designated hedge accounting relationships (1.4) –Financial liabilities measured at amortised cost (515.1) (575.0)b) Fair value of financial instrumentsThe fair values of financial assets and financial liabilities are determined as follows:2,273.6 1,793.4• the fair values of financial assets and financial liabilities with standard terms and conditions and tradedon active liquid markets are determined with reference to quoted market prices;• the fair values of other financial assets and financial liabilities (excluding derivative instruments) aredetermined in accordance with generally accepted pricing models based on discounted cash flow analysisusing prices from observable current market transactions; and• the fair values of derivative instruments are calculated using quoted prices. Where such prices are notavailable, use is made of discounted cash flow analysis based on the applicable yield curve for the durationof the instruments for non-optional derivatives, and option pricing models for optional derivatives.The fair value of each category of financial asset and liability is not materially different from the carrying valuespresented for either <strong>2007</strong> or 2006.c) Financial risk managementThe Group’s activities expose it to a variety of financial risks: market risk (including commodity price risk,currency risk, interest rate risk and other price risk), credit risk and liquidity risk. The Group uses derivativefinancial instruments to reduce exposure to commodity price, foreign exchange and interest rate movements.The Group does not use such derivative instruments for speculative trading purposes.FINANCIAL STATEMENTSThe Board of Directors is responsible for overseeing the Group’s risk management framework. The Board hasestablished the Quality and Risk Management Committee, which is responsible for developing and monitoringthe Group’s risk management policies. Internal Audit undertakes both regular and ad hoc reviews of riskmanagement controls and procedures, the results of which are reported to the Quality and Risk ManagementCommittee.(i) Commodity price riskThe Group generally sells its copper and molybdenum concentrate and copper cathodes output at prevailingmarket prices, subject to final pricing adjustments which may be 30 to 180 days after delivery to the customer,and it is therefore exposed to changes in market prices for copper and molybdenum both in respect of future114<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>