Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

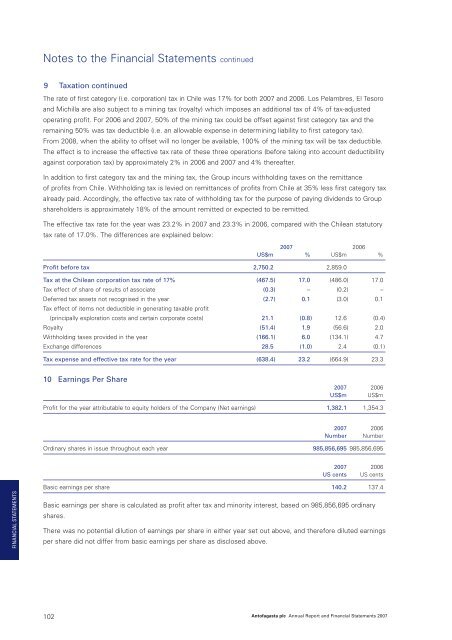

Notes to the Financial Statements continued9 Taxation continuedThe rate of first category (i.e. corporation) tax in Chile was 17% for both <strong>2007</strong> and 2006. Los Pelambres, El Tesoroand Michilla are also subject to a mining tax (royalty) which imposes an additional tax of 4% of tax-adjustedoperating profit. For 2006 and <strong>2007</strong>, 50% of the mining tax could be offset against first category tax and theremaining 50% was tax deductible (i.e. an allowable expense in determining liability to first category tax).From 2008, when the ability to offset will no longer be available, 100% of the mining tax will be tax deductible.The effect is to increase the effective tax rate of these three operations (before taking into account deductibilityagainst corporation tax) by approximately 2% in 2006 and <strong>2007</strong> and 4% thereafter.In addition to first category tax and the mining tax, the Group incurs withholding taxes on the remittanceof profits from Chile. Withholding tax is levied on remittances of profits from Chile at 35% less first category taxalready paid. Accordingly, the effective tax rate of withholding tax for the purpose of paying dividends to Groupshareholders is approximately 18% of the amount remitted or expected to be remitted.The effective tax rate for the year was 23.2% in <strong>2007</strong> and 23.3% in 2006, compared with the Chilean statutorytax rate of 17.0%. The differences are explained below:<strong>2007</strong> 2006US$m % US$m %Profit before tax 2,750.2 2,859.0Tax at the Chilean corporation tax rate of 17% (467.5) 17.0 (486.0) 17.0Tax effect of share of results of associate (0.3) – (0.2) –Deferred tax assets not recognised in the year (2.7) 0.1 (3.0) 0.1Tax effect of items not deductible in generating taxable profit(principally exploration costs and certain corporate costs) 21.1 (0.8) 12.6 (0.4)Royalty (51.4) 1.9 (56.6) 2.0Withholding taxes provided in the year (166.1) 6.0 (134.1) 4.7Exchange differences 28.5 (1.0) 2.4 (0.1)Tax expense and effective tax rate for the year (638.4) 23.2 (664.9) 23.310 Earnings Per Share<strong>2007</strong> 2006US$m US$mProfit for the year attributable to equity holders of the Company (Net earnings) 1,382.1 1,354.3<strong>2007</strong> 2006Number NumberOrdinary shares in issue throughout each year 985,856,695 985,856,695<strong>2007</strong> 2006US cents US centsFINANCIAL STATEMENTSBasic earnings per share 140.2 137.4Basic earnings per share is calculated as profit after tax and minority interest, based on 985,856,695 ordinaryshares.There was no potential dilution of earnings per share in either year set out above, and therefore diluted earningsper share did not differ from basic earnings per share as disclosed above.102<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>