Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

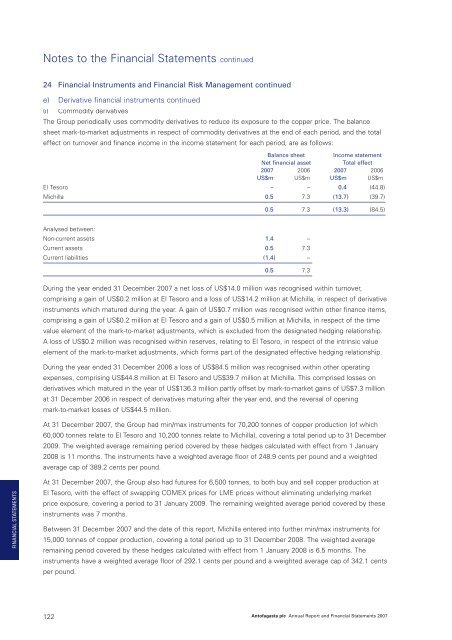

Notes to the Financial Statements continued24 Financial Instruments and Financial Risk Management continuede) Derivative financial instruments continued(i) Commodity derivativesThe Group periodically uses commodity derivatives to reduce its exposure to the copper price. The balancesheet mark-to-market adjustments in respect of commodity derivatives at the end of each period, and the totaleffect on turnover and finance income in the income statement for each period, are as follows:Balance sheet Income statementNet financial assetTotal effect<strong>2007</strong> 2006 <strong>2007</strong> 2006US$m US$m US$m US$mEl Tesoro – – 0.4 (44.8)Michilla 0.5 7.3 (13.7) (39.7)0.5 7.3 (13.3) (84.5)Analysed between:Non-current assets 1.4 –Current assets 0.5 7.3Current liabilities (1.4) –0.5 7.3During the year ended 31 December <strong>2007</strong> a net loss of US$14.0 million was recognised within turnover,comprising a gain of US$0.2 million at El Tesoro and a loss of US$14.2 million at Michilla, in respect of derivativeinstruments which matured during the year. A gain of US$0.7 million was recognised within other finance items,comprising a gain of US$0.2 million at El Tesoro and a gain of US$0.5 million at Michilla, in respect of the timevalue element of the mark-to-market adjustments, which is excluded from the designated hedging relationship.A loss of US$0.2 million was recognised within reserves, relating to El Tesoro, in respect of the intrinsic valueelement of the mark-to-market adjustments, which forms part of the designated effective hedging relationship.During the year ended 31 December 2006 a loss of US$84.5 million was recognised within other operatingexpenses, comprising US$44.8 million at El Tesoro and US$39.7 million at Michilla. This comprised losses onderivatives which matured in the year of US$136.3 million partly offset by mark-to-market gains of US$7.3 millionat 31 December 2006 in respect of derivatives maturing after the year end, and the reversal of openingmark-to-market losses of US$44.5 million.At 31 December <strong>2007</strong>, the Group had min/max instruments for 70,200 tonnes of copper production (of which60,000 tonnes relate to El Tesoro and 10,200 tonnes relate to Michilla), covering a total period up to 31 December2009. The weighted average remaining period covered by these hedges calculated with effect from 1 January2008 is 11 months. The instruments have a weighted average floor of 248.9 cents per pound and a weightedaverage cap of 389.2 cents per pound.FINANCIAL STATEMENTSAt 31 December <strong>2007</strong>, the Group also had futures for 6,500 tonnes, to both buy and sell copper production atEl Tesoro, with the effect of swapping COMEX prices for LME prices without eliminating underlying marketprice exposure, covering a period to 31 January 2009. The remaining weighted average period covered by theseinstruments was 7 months.Between 31 December <strong>2007</strong> and the date of this report, Michilla entered into further min/max instruments for15,000 tonnes of copper production, covering a total period up to 31 December 2008. The weighted averageremaining period covered by these hedges calculated with effect from 1 January 2008 is 6.5 months. Theinstruments have a weighted average floor of 292.1 cents per pound and a weighted average cap of 342.1 centsper pound.122<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>