Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

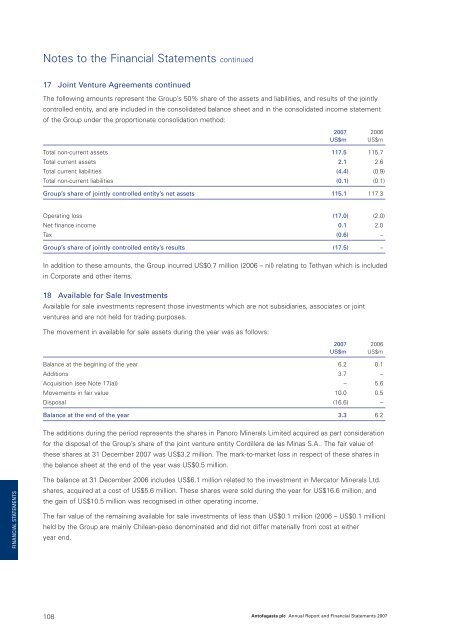

Notes to the Financial Statements continued17 Joint Venture Agreements continuedThe following amounts represent the Group’s 50% share of the assets and liabilities, and results of the jointlycontrolled entity, and are included in the consolidated balance sheet and in the consolidated income statementof the Group under the proportionate consolidation method:<strong>2007</strong> 2006US$m US$mTotal non-current assets 117.5 115.7Total current assets 2.1 2.6Total current liabilities (4.4) (0.9)Total non-current liabilities (0.1) (0.1)Group’s share of jointly controlled entity’s net assets 115.1 117.3Operating loss (17.0) (2.0)Net finance income 0.1 2.0Tax (0.6) –Group’s share of jointly controlled entity’s results (17.5) –In addition to these amounts, the Group incurred US$0.7 million (2006 – nil) relating to Tethyan which is includedin Corporate and other items.18 Available for Sale InvestmentsAvailable for sale investments represent those investments which are not subsidiaries, associates or jointventures and are not held for trading purposes.The movement in available for sale assets during the year was as follows:<strong>2007</strong> 2006US$m US$mBalance at the begining of the year 6.2 0.1Additions 3.7 –Acquisition (see Note 17(a)) – 5.6Movements in fair value 10.0 0.5Disposal (16.6) –Balance at the end of the year 3.3 6.2The additions during the period represents the shares in Panoro Minerals Limited acquired as part considerationfor the disposal of the Group’s share of the joint venture entity Cordillera de las Minas S.A.. The fair value ofthese shares at 31 December <strong>2007</strong> was US$3.2 million. The mark-to-market loss in respect of these shares inthe balance sheet at the end of the year was US$0.5 million.FINANCIAL STATEMENTSThe balance at 31 December 2006 includes US$6.1 million related to the investment in Mercator Minerals Ltd.shares, acquired at a cost of US$5.6 million. These shares were sold during the year for US$16.6 million, andthe gain of US$10.5 million was recognised in other operating income.The fair value of the remaining available for sale investments of less than US$0.1 million (2006 – US$0.1 million)held by the Group are mainly Chilean-peso denominated and did not differ materially from cost at eitheryear end.108<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>