Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

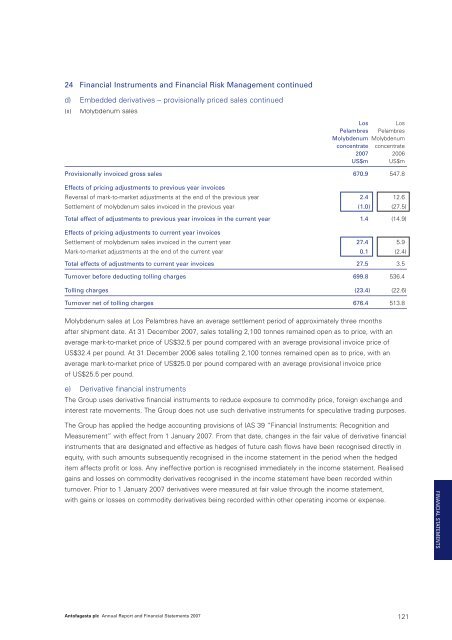

24 Financial Instruments and Financial Risk Management continuedd) Embedded derivatives – provisionally priced sales continued(ii) Molybdenum salesLos LosPelambres PelambresMolybdenum Molybdenumconcentrate concentrate<strong>2007</strong> 2006US$m US$mProvisionally invoiced gross sales 670.9 547.8Effects of pricing adjustments to previous year invoicesReversal of mark-to-market adjustments at the end of the previous year 2.4 12.6Settlement of molybdenum sales invoiced in the previous year (1.0) (27.5)Total effect of adjustments to previous year invoices in the current year 1.4 (14.9)Effects of pricing adjustments to current year invoicesSettlement of molybdenum sales invoiced in the current year 27.4 5.9Mark-to-market adjustments at the end of the current year 0.1 (2.4)Total effects of adjustments to current year invoices 27.5 3.5Turnover before deducting tolling charges 699.8 536.4Tolling charges (23.4) (22.6)Turnover net of tolling charges 676.4 513.8Molybdenum sales at Los Pelambres have an average settlement period of approximately three monthsafter shipment date. At 31 December <strong>2007</strong>, sales totalling 2,100 tonnes remained open as to price, with anaverage mark-to-market price of US$32.5 per pound compared with an average provisional invoice price ofUS$32.4 per pound. At 31 December 2006 sales totalling 2,100 tonnes remained open as to price, with anaverage mark-to-market price of US$25.0 per pound compared with an average provisional invoice priceof US$25.5 per pound.e) Derivative financial instrumentsThe Group uses derivative financial instruments to reduce exposure to commodity price, foreign exchange andinterest rate movements. The Group does not use such derivative instruments for speculative trading purposes.The Group has applied the hedge accounting provisions of IAS 39 “Financial Instruments: Recognition andMeasurement” with effect from 1 January <strong>2007</strong>. From that date, changes in the fair value of derivative financialinstruments that are designated and effective as hedges of future cash flows have been recognised directly inequity, with such amounts subsequently recognised in the income statement in the period when the hedgeditem affects profit or loss. Any ineffective portion is recognised immediately in the income statement. Realisedgains and losses on commodity derivatives recognised in the income statement have been recorded withinturnover. Prior to 1 January <strong>2007</strong> derivatives were measured at fair value through the income statement,with gains or losses on commodity derivatives being recorded within other operating income or expense.FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 121