Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

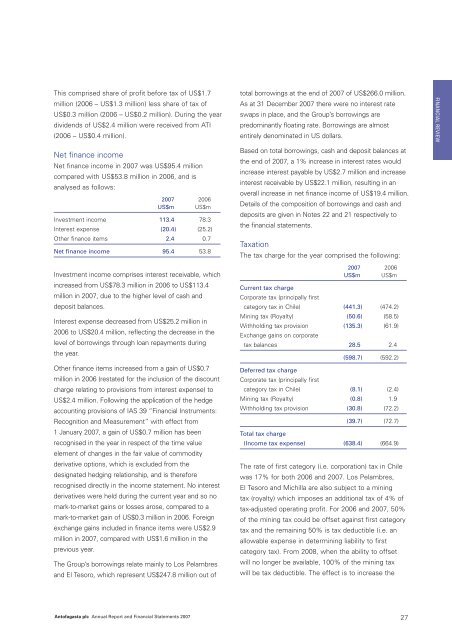

This comprised share of profit before tax of US$1.7million (2006 – US$1.3 million) less share of tax ofUS$0.3 million (2006 – US$0.2 million). During the yeardividends of US$2.4 million were received from ATI(2006 – US$0.4 million).total borrowings at the end of <strong>2007</strong> of US$266.0 million.As at 31 December <strong>2007</strong> there were no interest rateswaps in place, and the Group’s borrowings arepredominantly floating rate. Borrowings are almostentirely denominated in US dollars.FINANCIAL REVIEWNet finance incomeNet finance income in <strong>2007</strong> was US$95.4 millioncompared with US$53.8 million in 2006, and isanalysed as follows:<strong>2007</strong> 2006US$m US$mInvestment income 113.4 78.3Interest expense (20.4) (25.2)Other finance items 2.4 0.7Net finance income 95.4 53.8Investment income comprises interest receivable, whichincreased from US$78.3 million in 2006 to US$113.4million in <strong>2007</strong>, due to the higher level of cash anddeposit balances.Interest expense decreased from US$25.2 million in2006 to US$20.4 million, reflecting the decrease in thelevel of borrowings through loan repayments duringthe year.Other finance items increased from a gain of US$0.7million in 2006 (restated for the inclusion of the discountcharge relating to provisions from interest expense) toUS$2.4 million. Following the application of the hedgeaccounting provisions of IAS 39 “Financial Instruments:Recognition and Measurement” with effect from1 January <strong>2007</strong>, a gain of US$0.7 million has beenrecognised in the year in respect of the time valueelement of changes in the fair value of commodityderivative options, which is excluded from thedesignated hedging relationship, and is thereforerecognised directly in the income statement. No interestderivatives were held during the current year and so nomark-to-market gains or losses arose, compared to amark-to-market gain of US$0.3 million in 2006. Foreignexchange gains included in finance items were US$2.9million in <strong>2007</strong>, compared with US$1.6 million in theprevious year.The Group’s borrowings relate mainly to Los Pelambresand El Tesoro, which represent US$247.8 million out ofBased on total borrowings, cash and deposit balances atthe end of <strong>2007</strong>, a 1% increase in interest rates wouldincrease interest payable by US$2.7 million and increaseinterest receivable by US$22.1 million, resulting in anoverall increase in net finance income of US$19.4 million.Details of the composition of borrowings and cash anddeposits are given in Notes 22 and 21 respectively tothe financial statements.TaxationThe tax charge for the year comprised the following:<strong>2007</strong> 2006US$m US$mCurrent tax chargeCorporate tax (principally firstcategory tax in Chile) (441.3) (474.2)Mining tax (Royalty) (50.6) (58.5)Withholding tax provision (135.3) (61.9)Exchange gains on corporatetax balances 28.5 2.4(598.7) (592.2)Deferred tax chargeCorporate tax (principally firstcategory tax in Chile) (8.1) (2.4)Mining tax (Royalty) (0.8) 1.9Withholding tax provision (30.8) (72.2)(39.7) (72.7)Total tax charge(Income tax expense) (638.4) (664.9)The rate of first category (i.e. corporation) tax in Chilewas 17% for both 2006 and <strong>2007</strong>. Los Pelambres,El Tesoro and Michilla are also subject to a miningtax (royalty) which imposes an additional tax of 4% oftax-adjusted operating profit. For 2006 and <strong>2007</strong>, 50%of the mining tax could be offset against first categorytax and the remaining 50% is tax deductible (i.e. anallowable expense in determining liability to firstcategory tax). From 2008, when the ability to offsetwill no longer be available, 100% of the mining taxwill be tax deductible. The effect is to increase the<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 27