Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

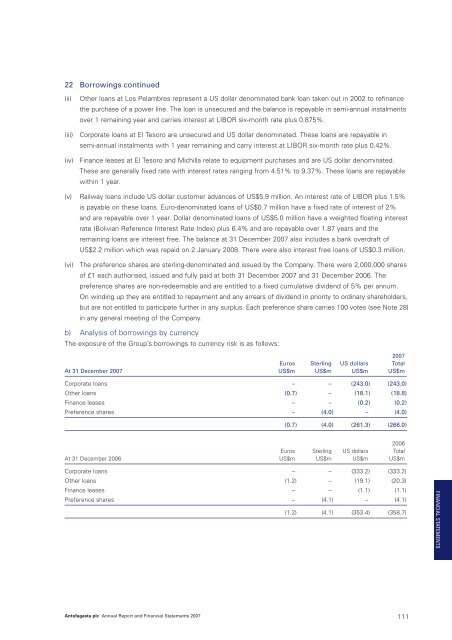

22 Borrowings continued(ii)Other loans at Los Pelambres represent a US dollar denominated bank loan taken out in 2002 to refinancethe purchase of a power line. The loan is unsecured and the balance is repayable in semi-annual instalmentsover 1 remaining year and carries interest at LIBOR six-month rate plus 0.875%.(iii) Corporate loans at El Tesoro are unsecured and US dollar denominated. These loans are repayable insemi-annual instalments with 1 year remaining and carry interest at LIBOR six-month rate plus 0.42%.(iv) Finance leases at El Tesoro and Michilla relate to equipment purchases and are US dollar denominated.These are generally fixed rate with interest rates ranging from 4.51% to 9.37%. These loans are repayablewithin 1 year.(v) Railway loans include US dollar customer advances of US$5.9 million. An interest rate of LIBOR plus 1.5%is payable on these loans. Euro-denominated loans of US$0.7 million have a fixed rate of interest of 2%and are repayable over 1 year. Dollar denominated loans of US$5.0 million have a weighted floating interestrate (Bolivian Reference Interest Rate Index) plus 6.4% and are repayable over 1.87 years and theremaining loans are interest free. The balance at 31 December <strong>2007</strong> also includes a bank overdraft ofUS$2.2 million which was repaid on 2 January 2008. There were also interest free loans of US$0.3 million.(vi) The preference shares are sterling-denominated and issued by the Company. There were 2,000,000 sharesof £1 each authorised, issued and fully paid at both 31 December <strong>2007</strong> and 31 December 2006. Thepreference shares are non-redeemable and are entitled to a fixed cumulative dividend of 5% per annum.On winding up they are entitled to repayment and any arrears of dividend in priority to ordinary shareholders,but are not entitled to participate further in any surplus. Each preference share carries 100 votes (see Note 28)in any general meeting of the Company.b) Analysis of borrowings by currencyThe exposure of the Group’s borrowings to currency risk is as follows:<strong>2007</strong>Euros Sterling US dollars TotalAt 31 December <strong>2007</strong> US$m US$m US$m US$mCorporate loans – – (243.0) (243.0)Other loans (0.7) – (18.1) (18.8)Finance leases – – (0.2) (0.2)Preference shares – (4.0) – (4.0)(0.7) (4.0) (261.3) (266.0)2006Euros Sterling US dollars TotalAt 31 December 2006 US$m US$m US$m US$mCorporate loans – – (333.2) (333.2)Other loans (1.2) – (19.1) (20.3)Finance leases – – (1.1) (1.1)Preference shares – (4.1) – (4.1)(1.2) (4.1) (353.4) (358.7)FINANCIAL STATEMENTS<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 111