Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Annual Report 2007 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

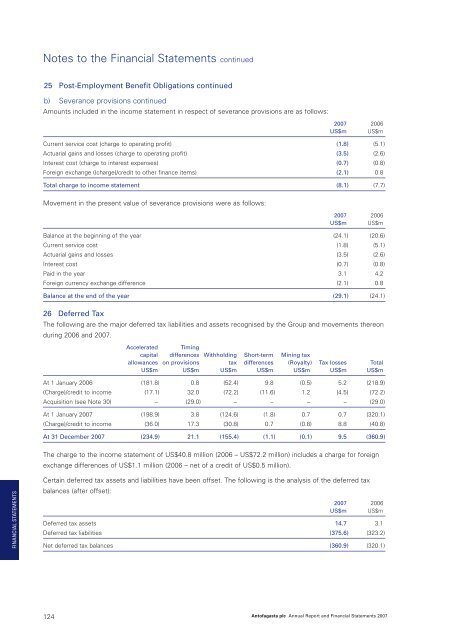

Notes to the Financial Statements continued25 Post-Employment Benefit Obligations continuedb) Severance provisions continuedAmounts included in the income statement in respect of severance provisions are as follows:<strong>2007</strong> 2006US$m US$mCurrent service cost (charge to operating profit) (1.8) (5.1)Actuarial gains and losses (charge to operating profit) (3.5) (2.6)Interest cost (charge to interest expenses) (0.7) (0.8)Foreign exchange ((charge)/credit to other finance items) (2.1) 0.8Total charge to income statement (8.1) (7.7)Movement in the present value of severance provisions were as follows:<strong>2007</strong> 2006US$m US$mBalance at the beginning of the year (24.1) (20.6)Current service cost (1.8) (5.1)Actuarial gains and losses (3.5) (2.6)Interest cost (0.7) (0.8)Paid in the year 3.1 4.2Foreign currency exchange difference (2.1) 0.8Balance at the end of the year (29.1) (24.1)26 Deferred TaxThe following are the major deferred tax liabilities and assets recognised by the Group and movements thereonduring 2006 and <strong>2007</strong>.Accelerated Timingcapital differences Withholding Short-term Mining taxallowances on provisions tax differences (Royalty) Tax losses TotalUS$m US$m US$m US$m US$m US$m US$mAt 1 January 2006 (181.8) 0.8 (52.4) 9.8 (0.5) 5.2 (218.9)(Charge)/credit to income (17.1) 32.0 (72.2) (11.6) 1.2 (4.5) (72.2)Acquisition (see Note 30) – (29.0) – – – – (29.0)At 1 January <strong>2007</strong> (198.9) 3.8 (124.6) (1.8) 0.7 0.7 (320.1)(Charge)/credit to income (36.0) 17.3 (30.8) 0.7 (0.8) 8.8 (40.8)At 31 December <strong>2007</strong> (234.9) 21.1 (155.4) (1.1) (0.1) 9.5 (360.9)The charge to the income statement of US$40.8 million (2006 – US$72.2 million) includes a charge for foreignexchange differences of US$1.1 million (2006 – net of a credit of US$0.5 million).FINANCIAL STATEMENTSCertain deferred tax assets and liabilities have been offset. The following is the analysis of the deferred taxbalances (after offset):<strong>2007</strong> 2006US$m US$mDeferred tax assets 14.7 3.1Deferred tax liabilities (375.6) (323.2)Net deferred tax balances (360.9) (320.1)124<strong>Antofagasta</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong>