Hedge funds and Private Equity - PES

Hedge funds and Private Equity - PES

Hedge funds and Private Equity - PES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

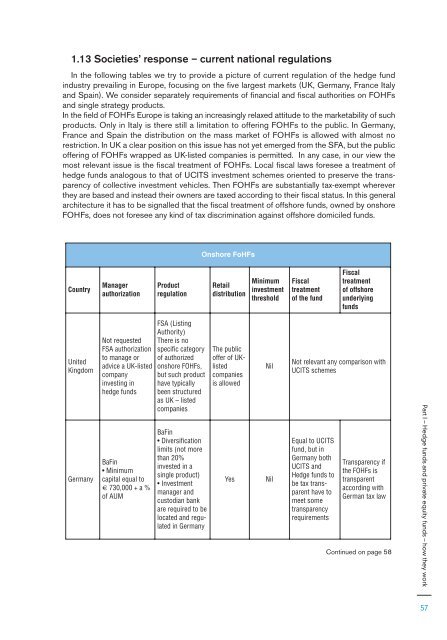

1.13 Societies’ response – current national regulations<br />

In the following tables we try to provide a picture of current regulation of the hedge fund<br />

industry prevailing in Europe, focusing on the five largest markets (UK, Germany, France Italy<br />

<strong>and</strong> Spain). We consider separately requirements of financial <strong>and</strong> fiscal authorities on FOHFs<br />

<strong>and</strong> single strategy products.<br />

In the field of FOHFs Europe is taking an increasingly relaxed attitude to the marketability of such<br />

products. Only in Italy is there still a limitation to offering FOHFs to the public. In Germany,<br />

France <strong>and</strong> Spain the distribution on the mass market of FOHFs is allowed with almost no<br />

restriction. In UK a clear position on this issue has not yet emerged from the SFA, but the public<br />

offering of FOHFs wrapped as UK-listed companies is permitted. In any case, in our view the<br />

most relevant issue is the fiscal treatment of FOHFs. Local fiscal laws foresee a treatment of<br />

hedge <strong>funds</strong> analogous to that of UCITS investment schemes oriented to preserve the transparency<br />

of collective investment vehicles. Then FOHFs are substantially tax-exempt wherever<br />

they are based <strong>and</strong> instead their owners are taxed according to their fiscal status. In this general<br />

architecture it has to be signalled that the fiscal treatment of offshore <strong>funds</strong>, owned by onshore<br />

FOHFs, does not foresee any kind of tax discrimination against offshore domiciled <strong>funds</strong>.<br />

Country<br />

United<br />

Kingdom<br />

Germany<br />

Manager<br />

authorization<br />

Not requested<br />

FSA authorization<br />

to manage or<br />

advice a UK-listed<br />

company<br />

investing in<br />

hedge <strong>funds</strong><br />

BaFin<br />

Minimum<br />

capital equal to<br />

€ 730,000 + a %<br />

of AUM<br />

Product<br />

regulation<br />

FSA (Listing<br />

Authority)<br />

There is no<br />

specific category<br />

of authorized<br />

onshore FOHFs,<br />

but such product<br />

have typically<br />

been structured<br />

as UK – listed<br />

companies<br />

BaFin<br />

Diversification<br />

limits (not more<br />

than 20%<br />

invested in a<br />

single product)<br />

Investment<br />

manager <strong>and</strong><br />

custodian bank<br />

are required to be<br />

located <strong>and</strong> regulated<br />

in Germany<br />

Onshore FoHFs<br />

Retail<br />

distribution<br />

The public<br />

offer of UKlisted<br />

companies<br />

is allowed<br />

Minimum<br />

investment<br />

threshold<br />

Nil<br />

Yes Nil<br />

Fiscal<br />

treatment<br />

of the fund<br />

Fiscal<br />

treatment<br />

of offshore<br />

underlying<br />

<strong>funds</strong><br />

Not relevant any comparison with<br />

UCITS schemes<br />

Equal to UCITS<br />

fund, but in<br />

Germany both<br />

UCITS <strong>and</strong><br />

<strong>Hedge</strong> <strong>funds</strong> to<br />

be tax transparent<br />

have to<br />

meet some<br />

transparency<br />

requirements<br />

Transparency if<br />

the FOHFs is<br />

transparent<br />

according with<br />

German tax law<br />

Continued on page 58<br />

Part I – <strong>Hedge</strong> <strong>funds</strong> <strong>and</strong> private equity <strong>funds</strong> – how they work<br />

57