Academic Calendar 2011-2012 - Chesapeake College

Academic Calendar 2011-2012 - Chesapeake College

Academic Calendar 2011-2012 - Chesapeake College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

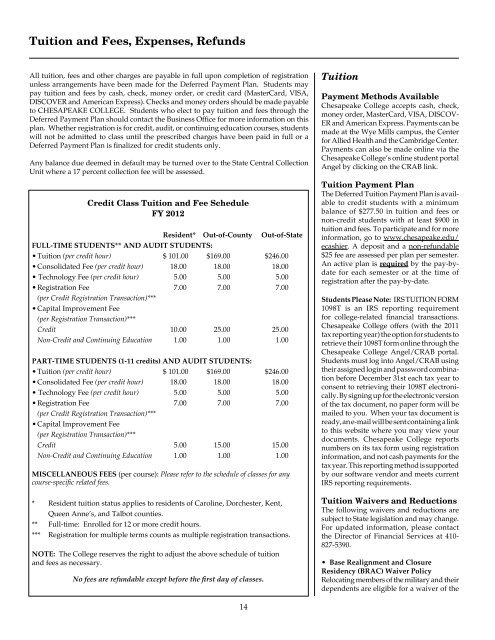

Tuition and Fees, Expenses, RefundsAll tuition, fees and other charges are payable in full upon completion of registrationunless arrangements have been made for the Deferred Payment Plan. Students maypay tuition and fees by cash, check, money order, or credit card (MasterCard, VISA,DISCOVER and American Express). Checks and money orders should be made payableto CHESAPEAKE COLLEGE. Students who elect to pay tuition and fees through theDeferred Payment Plan should contact the Business Office for more information on thisplan. Whether registration is for credit, audit, or continuing education courses, studentswill not be admitted to class until the prescribed charges have been paid in full or aDeferred Payment Plan is finalized for credit students only.Any balance due deemed in default may be turned over to the State Central CollectionUnit where a 17 percent collection fee will be assessed.Credit Class Tuition and Fee ScheduleFY <strong>2012</strong>Resident* Out-of-County Out-of-StateFULL-TIME STUDENTS** AND AUDIT STUDENTS:• Tuition (per credit hour) $ 101.00 $169.00 $246.00• Consolidated Fee (per credit hour) 18.00 18.00 18.00• Technology Fee (per credit hour) 5.00 5.00 5.00• Registration Fee 7.00 7.00 7.00(per Credit Registration Transaction)***• Capital Improvement Fee(per Registration Transaction)***Credit 10.00 25.00 25.00Non-Credit and Continuing Education 1.00 1.00 1.00PART-TIME STUDENTS (1-11 credits) AND AUDIT STUDENTS:• Tuition (per credit hour) $ 101.00 $169.00 $246.00• Consolidated Fee (per credit hour) 18.00 18.00 18.00• Technology Fee (per credit hour) 5.00 5.00 5.00• Registration Fee 7.00 7.00 7.00(per Credit Registration Transaction)***• Capital Improvement Fee(per Registration Transaction)***Credit 5.00 15.00 15.00Non-Credit and Continuing Education 1.00 1.00 1.00MISCELLANEOUS FEES (per course): Please refer to the schedule of classes for anycourse-specific related fees.* Resident tuition status applies to residents of Caroline, Dorchester, Kent,Queen Anne’s, and Talbot counties.** Full-time: Enrolled for 12 or more credit hours.*** Registration for multiple terms counts as multiple registration transactions.Note: The <strong>College</strong> reserves the right to adjust the above schedule of tuitionand fees as necessary.No fees are refundable except before the first day of classes.TuitionPayment Methods Available<strong>Chesapeake</strong> <strong>College</strong> accepts cash, check,money order, MasterCard, VISA, DISCOV-ER and American Express. Payments can bemade at the Wye Mills campus, the Centerfor Allied Health and the Cambridge Center.Payments can also be made online via the<strong>Chesapeake</strong> <strong>College</strong>’s online student portalAngel by clicking on the CRAB link.Tuition Payment PlanThe Deferred Tuition Payment Plan is availableto credit students with a minimumbalance of $277.50 in tuition and fees ornon-credit students with at least $900 intuition and fees. To participate and for moreinformation, go to www.chesapeake.edu/ecashier. A deposit and a non-refundable$25 fee are assessed per plan per semester.An active plan is required by the pay-bydatefor each semester or at the time ofregistration after the pay-by-date.Students Please Note: IRS TUITION FORM1098T is an IRS reporting requirementfor college-related financial transactions.<strong>Chesapeake</strong> <strong>College</strong> offers (with the <strong>2011</strong>tax reporting year) the option for students toretrieve their 1098T form online through the<strong>Chesapeake</strong> <strong>College</strong> Angel/CRAB portal.Students must log into Angel/CRAB usingtheir assigned login and password combinationbefore December 31st each tax year toconsent to retrieving their 1098T electronically.By signing up for the electronic versionof the tax document, no paper form will bemailed to you. When your tax document isready, an e-mail will be sent containing a linkto this website where you may view yourdocuments. <strong>Chesapeake</strong> <strong>College</strong> reportsnumbers on its tax form using registrationinformation, and not cash payments for thetax year. This reporting method is supportedby our software vendor and meets currentIRS reporting requirements.Tuition Waivers and ReductionsThe following waivers and reductions aresubject to State legislation and may change.For updated information, please contactthe Director of Financial Services at 410-827-5390.• Base Realignment and ClosureResidency (BRAC) Waiver PolicyRelocating members of the military and theirdependents are eligible for a waiver of the14