- Page 2 and 3:

Academic Calendar 2011-2012fall 201

- Page 4 and 5:

NOTICE TO STUDENTSWhle ths Catalog

- Page 6 and 7:

BOARD OF TRUSTEESCaroline CountyMar

- Page 8 and 9:

Directory of Telephone Service and

- Page 10:

Faculty DirectoryKamal P. Hennayake

- Page 14 and 15:

General InformationRegistration Off

- Page 16 and 17:

General inFormationHarassment Polic

- Page 18 and 19:

Admissions and Placement3. Students

- Page 20 and 21:

aDmissions anD PlacementD. Credit b

- Page 22 and 23:

aDmissions anD PlacementIf the stud

- Page 24 and 25:

Non-Traditional StudiesSpecial Stud

- Page 26 and 27: Tuition and Fees, Expenses, Refunds

- Page 28 and 29: tuition anD Fees, exPenses, reFunDs

- Page 30 and 31: Student Financial assistanceFederal

- Page 32 and 33: stuDent Financial assistanceSummer

- Page 34 and 35: Student Financial AssistanceEndowed

- Page 36 and 37: Student Financial AssistanceAward p

- Page 38 and 39: Student Financial AssistanceOxford

- Page 40 and 41: Student Financial AssistanceConditi

- Page 42 and 43: stuDent Financial assistanceThe Fin

- Page 44 and 45: Student Financial Assistance6. Subt

- Page 46 and 47: Student Financial AssistanceThe Uni

- Page 48 and 49: stuDent Financial assistanceCost of

- Page 50 and 51: Student Records and PoliciesJohn T.

- Page 52 and 53: Grading PoliciesGrading SystemGrade

- Page 54 and 55: Student Services and PoliciesServic

- Page 56 and 57: Student Services and PoliciesStuden

- Page 58 and 59: stuDent services anD PoliciesU. Haz

- Page 60 and 61: Dual Enrollment for High School Stu

- Page 62 and 63: Gifted and Talented programChesapea

- Page 64 and 65: Statewide ProgramsHuman Services*Al

- Page 66 and 67: Opportunities for CompletionAssocia

- Page 68 and 69: ProGrams oF stuDyTransfer ProgramsT

- Page 70 and 71: General eDucation ProGramState Gene

- Page 72 and 73: Areas of StudyProgram/Major Code Aw

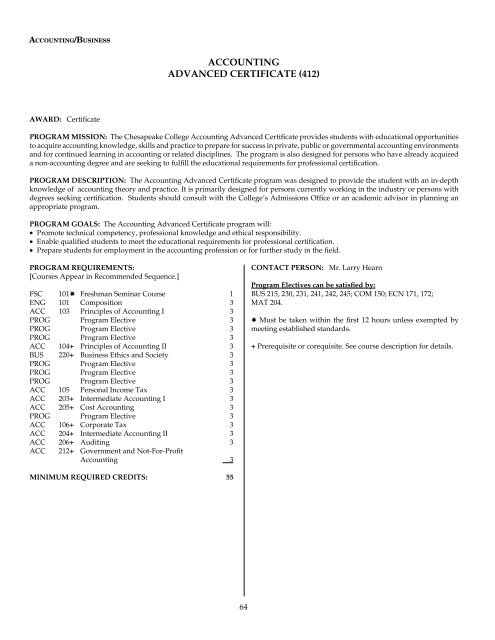

- Page 74 and 75: accountinG/BusinessThe College offe

- Page 78 and 79: accountinG/BusinessBUSINESS ADMINIS

- Page 80 and 81: accountinG/BusinessBUSINESS MANAGEM

- Page 82 and 83: comPuter stuDiesThe College offers

- Page 84 and 85: comPuter stuDiesCOMPUTER INFORMATIO

- Page 86 and 87: comPuter stuDiesINTERACTIVE MEDIA A

- Page 88 and 89: comPuter stuDiesMICROCOMPUTER APPLI

- Page 90 and 91: comPuter stuDiesCOMPUTER INFORMATIO

- Page 92 and 93: comPuter stuDiesEDUCATIONAL TECHNOL

- Page 94 and 95: criminal JusticeCORRECTIONSCERTIFIC

- Page 96 and 97: criminal JusticeCRIMINAL JUSTICE DE

- Page 98 and 99: criminal JusticeCRIMINAL JUSTICE DE

- Page 100 and 101: criminal JusticeNATURAL RESOURCESCE

- Page 102 and 103: eDucation/teacHinGEARLY CHILDHOOD D

- Page 104 and 105: eDucation/teacHinGEARLY CHILDHOOD D

- Page 106 and 107: eDucation/teacHinGELEMENTARY EDUCAT

- Page 108 and 109: eDucation/teacHinGSECONDARY EDUCATI

- Page 110 and 111: eDucation/teacHinGSECONDARY EDUCATI

- Page 112 and 113: eDucation/teacHinGSECONDARY EDUCATI

- Page 114 and 115: eDucation/teacHinGSECONDARY EDUCATI

- Page 116 and 117: eDucation/teacHinGTEACHER AIDECERTI

- Page 118 and 119: enGineerinG tecHnoloGyENGINEERING T

- Page 120 and 121: enGineerinG tecHnoloGyWELDINGADVANC

- Page 122 and 123: ENVIrONmENTal SCIENCEThe College of

- Page 124 and 125: environmental scienceENVIRONMENTAL

- Page 126 and 127:

environmental scienceLAND USE MANAG

- Page 128 and 129:

HealtH ProFessionsNURSINGSCIENCE LA

- Page 130 and 131:

HealtH ProFessionsEMERGENCY MEDICAL

- Page 132 and 133:

HealtH ProFessionsEMERGENCY MEDICAL

- Page 134 and 135:

HealtH ProFessionsGENERAL COLLEGE S

- Page 136 and 137:

HealtH ProFessionsNURSING: REGISTER

- Page 138 and 139:

HealtH ProFessionsPHLEBOTOMYLETTER

- Page 140 and 141:

Health ProfessionsPHYSICAL THERAPIS

- Page 142 and 143:

HealtH ProFessionsRADIOLOGIC SCIENC

- Page 144 and 145:

HealtH ProFessionsSCIENCE LABORATOR

- Page 146 and 147:

HealtH ProFessionsSURGICAL TECHNOLO

- Page 148 and 149:

Hotel/restaurant manaGementHOTEL/RE

- Page 150 and 151:

Hotel/restaurant manaGementHOTEL/RE

- Page 152:

Human servicesHUMAN SERVICES DEGREE

- Page 155 and 156:

liBeral arts anD sciencesLIBERAL AR

- Page 157 and 158:

liBeral arts anD sciencesLIBERAL AR

- Page 159 and 160:

liBeral arts anD sciencesLIBERAL AR

- Page 161 and 162:

liBeral arts anD sciencesCOMMUNICAT

- Page 163 and 164:

liBeral arts anD sciencesMusiC CoMp

- Page 165 and 166:

liBeral arts anD sciencesLIBERAL AR

- Page 167 and 168:

liBeral arts anD sciencesMATHEMATIC

- Page 169 and 170:

liBeral arts anD sciencesTRANSFER S

- Page 171 and 172:

ParaleGal ProFessionsThe College of

- Page 173 and 174:

ParaleGal ProFessionsPARALEGAL STUD

- Page 175 and 176:

tecHnical/ProFessional stuDiesTECHN

- Page 177 and 178:

course DescriPtionsEfforts wll be m

- Page 179 and 180:

allIED HEalTH • aNTHrOpOlOGy •

- Page 181 and 182:

arT • BIOlOGyworkng knowledge of

- Page 183 and 184:

BUSINESS • CarDIaC rESCUE TECHNIC

- Page 185 and 186:

CHEmISTry • COmmUNICaTION • COm

- Page 187 and 188:

COmpUTEr INFOrmaTION SySTEmSfile sy

- Page 189 and 190:

CrImINal JUSTICE • DEVElOpmENTal

- Page 191 and 192:

Early CHIlDHOOD DEVElOpmENT • ECO

- Page 193 and 194:

EDUCaTION • ElECTrONICS TECHNOlOG

- Page 195 and 196:

EmErGENCy mEDICal TECHNICIaN • EN

- Page 197 and 198:

ENGlISH • ESl • FIlm • FooD s

- Page 199 and 200:

GeoGraPHy • HealtH eD • History

- Page 201 and 202:

Humanities • interactive meDia &

- Page 203 and 204:

matHematicsMAT 031 Elementary Algeb

- Page 205 and 206:

mUSIC • NUrSINGMUS 166 Piano Clas

- Page 207 and 208:

NUrSING • NUTrITION • paralEGal

- Page 209 and 210:

pHySICal THErapIST aSSISTaNTPHYSICA

- Page 211 and 212:

PsycHoloGy • raDioloGic sciencesP

- Page 213 and 214:

aDioloGic sciences • scienceRSR 2

- Page 215 and 216:

surGical tecHnoloGy • tecHnoloGy

- Page 217 and 218:

DinG205

- Page 219 and 220:

College Administration, Staff and F

- Page 221 and 222:

College Administration, Staff and F

- Page 223 and 224:

College Administration, Staff and F

- Page 225 and 226:

College Administration, Staff and F

- Page 227 and 228:

Curriculum Advisory CommitteesARTCa

- Page 229 and 230:

AddendumAppendix 1.Student Transfer

- Page 231 and 232:

Addendumcollege is definable as a p

- Page 233 and 234:

Addendumability of courses at 4-yea

- Page 235 and 236:

Addendumshall be encouraged to comp

- Page 237 and 238:

AddendumE. Sending Institution: The

- Page 239 and 240:

IndexAAbility to Benefit, Student F

- Page 241 and 242:

IndexComputer Information Systems,

- Page 243 and 244:

IndexEnrollment Status, Conditions

- Page 245 and 246:

IndexLetter of Recognition, Graduat

- Page 247 and 248:

IndexSSatisfactory Academic Progres

- Page 249:

DIRECTIONS FROM ANNAPOLIS AND POINT