Academic Calendar 2011-2012 - Chesapeake College

Academic Calendar 2011-2012 - Chesapeake College

Academic Calendar 2011-2012 - Chesapeake College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

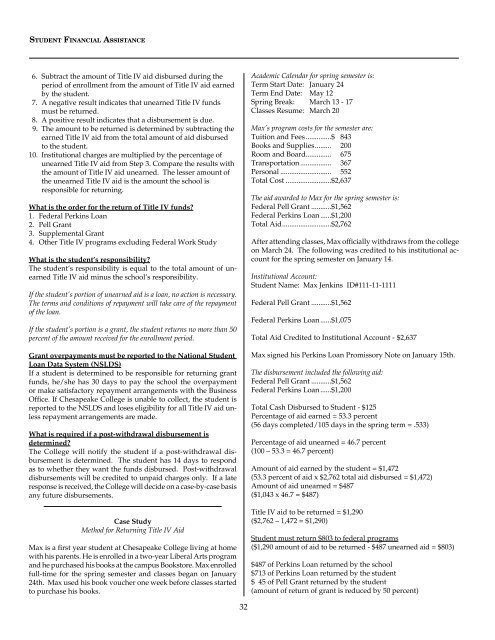

Student Financial Assistance6. Subtract the amount of Title IV aid disbursed during theperiod of enrollment from the amount of Title IV aid earnedby the student.7. A negative result indicates that unearned Title IV fundsmust be returned.8. A positive result indicates that a disbursement is due.9. The amount to be returned is determined by subtracting theearned Title IV aid from the total amount of aid disbursedto the student.10. Institutional charges are multiplied by the percentage ofunearned Title IV aid from Step 3. Compare the results withthe amount of Title IV aid unearned. The lesser amount ofthe unearned Title IV aid is the amount the school isresponsible for returning.What is the order for the return of Title IV funds?1. Federal Perkins Loan2. Pell Grant3. Supplemental Grant4. Other Title IV programs excluding Federal Work StudyWhat is the student’s responsibility?The student’s responsibility is equal to the total amount of unearnedTitle IV aid minus the school’s responsibility.If the student’s portion of unearned aid is a loan, no action is necessary.The terms and conditions of repayment will take care of the repaymentof the loan.If the student’s portion is a grant, the student returns no more than 50percent of the amount received for the enrollment period.Grant overpayments must be reported to the National StudentLoan Data System (NSLDS)If a student is determined to be responsible for returning grantfunds, he/she has 30 days to pay the school the overpaymentor make satisfactory repayment arrangements with the BusinessOffice. If <strong>Chesapeake</strong> <strong>College</strong> is unable to collect, the student isreported to the NSLDS and loses eligibility for all Title IV aid unlessrepayment arrangements are made.What is required if a post-withdrawal disbursement isdetermined?The <strong>College</strong> will notify the student if a post-withdrawal disbursementis determined. The student has 14 days to respondas to whether they want the funds disbursed. Post-withdrawaldisbursements will be credited to unpaid charges only. If a lateresponse is received, the <strong>College</strong> will decide on a case-by-case basisany future disbursements.Case StudyMethod for Returning Title IV AidMax is a first year student at <strong>Chesapeake</strong> <strong>College</strong> living at homewith his parents. He is enrolled in a two-year Liberal Arts programand he purchased his books at the campus Bookstore. Max enrolledfull-time for the spring semester and classes began on January24th. Max used his book voucher one week before classes startedto purchase his books.<strong>Academic</strong> <strong>Calendar</strong> for spring semester is:Term Start Date: January 24Term End Date: May 12Spring Break: March 13 - 17Classes Resume: March 20Max’s program costs for the semester are:Tuition and Fees...............$ 843Books and Supplies......... 200Room and Board.............. 675Transportation.................. 367Personal............................. 552Total Cost..........................$2,637The aid awarded to Max for the spring semester is:Federal Pell Grant............$1,562Federal Perkins Loan.......$1,200Total Aid...........................$2,762After attending classes, Max officially withdraws from the collegeon March 24. The following was credited to his institutional accountfor the spring semester on January 14.Institutional Account:Student Name: Max Jenkins ID#111-11-1111Federal Pell Grant............$1,562Federal Perkins Loan.......$1,075Total Aid Credited to Institutional Account - $2,637Max signed his Perkins Loan Promissory Note on January 15th.The disbursement included the following aid:Federal Pell Grant............$1,562Federal Perkins Loan.......$1,200Total Cash Disbursed to Student - $125Percentage of aid earned = 53.3 percent(56 days completed/105 days in the spring term = .533)Percentage of aid unearned = 46.7 percent(100 – 53.3 = 46.7 percent)Amount of aid earned by the student = $1,472(53.3 percent of aid x $2,762 total aid disbursed = $1,472)Amount of aid unearned = $487($1,043 x 46.7 = $487)Title IV aid to be returned = $1,290($2,762 – 1,472 = $1,290)Student must return $803 to federal programs($1,290 amount of aid to be returned - $487 unearned aid = $803)$487 of Perkins Loan returned by the school$713 of Perkins Loan returned by the student$ 45 of Pell Grant returned by the student(amount of return of grant is reduced by 50 percent)32