2011-2012 Annual Report - Full Version - PDF - Palmerston North ...

2011-2012 Annual Report - Full Version - PDF - Palmerston North ...

2011-2012 Annual Report - Full Version - PDF - Palmerston North ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

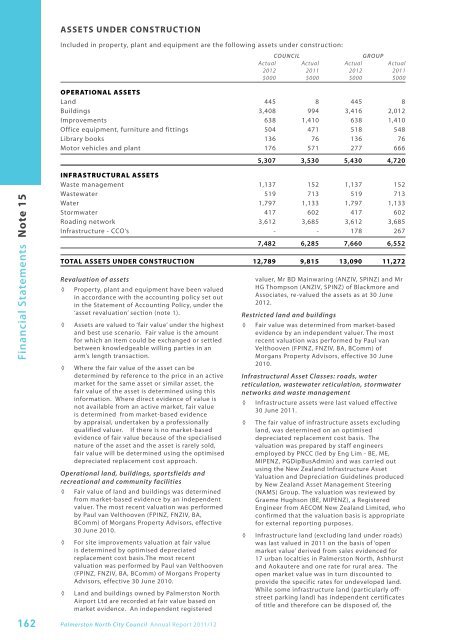

Assets under constructionIncluded in property, plant and equipment are the following assets under construction:CouncilGroupActual Actual Actual Actual<strong>2012</strong> <strong>2011</strong> <strong>2012</strong> <strong>2011</strong>$000 $000 $000 $000OPERATIONAL ASSETSLand 445 8 445 8Buildings 3,408 994 3,416 2,012Improvements 638 1,410 638 1,410Office equipment, furniture and fittings 504 471 518 548Library books 136 76 136 76Motor vehicles and plant 176 571 277 6665,307 3,530 5,430 4,720Financial Statements Note 15162INFRASTRUCTURAL ASSETSWaste management 1,137 152 1,137 152Wastewater 519 713 519 713Water 1,797 1,133 1,797 1,133Stormwater 417 602 417 602Roading network 3,612 3,685 3,612 3,685Infrastructure - CCO’s - - 178 267Revaluation of assets◊◊◊Property, plant and equipment have been valuedin accordance with the accounting policy set outin the Statement of Accounting Policy, under the‘asset revaluation’ section (note 1).Assets are valued to ‘fair value’ under the highestand best use scenario. Fair value is the amountfor which an item could be exchanged or settledbetween knowledgeable willing parties in anarm’s length transaction.Where the fair value of the asset can bedetermined by reference to the price in an activemarket for the same asset or similar asset, thefair value of the asset is determined using thisinformation. Where direct evidence of value isnot available from an active market, fair valueis determined from market-based evidenceby appraisal, undertaken by a professionallyqualified valuer. If there is no market-basedevidence of fair value because of the specialisednature of the asset and the asset is rarely sold,fair value will be determined using the optimiseddepreciated replacement cost approach.Operational land, buildings, sportsfields andrecreational and community facilities◊◊◊Fair value of land and buildings was determinedfrom market-based evidence by an independentvaluer. The most recent valuation was performedby Paul van Velthooven (FPINZ, FNZIV, BA,BComm) of Morgans Property Advisors, effective30 June 2010.For site improvements valuation at fair valueis determined by optimised depreciatedreplacement cost basis.The most recentvaluation was performed by Paul van Velthooven(FPINZ, FNZIV, BA, BComm) of Morgans PropertyAdvisors, effective 30 June 2010.Land and buildings owned by <strong>Palmerston</strong> <strong>North</strong>Airport Ltd are recorded at fair value based onmarket evidence. An independent registered<strong>Palmerston</strong> <strong>North</strong> City Council <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>/12valuer, Mr BD Mainwaring (ANZIV, SPINZ) and MrHG Thompson (ANZIV, SPINZ) of Blackmore andAssociates, re-valued the assets as at 30 June<strong>2012</strong>.Restricted land and buildings◊ Fair value was determined from market-basedevidence by an independent valuer. The mostrecent valuation was performed by Paul vanVelthooven (FPINZ, FNZIV, BA, BComm) ofMorgans Property Advisors, effective 30 June2010.Infrastructural Asset Classes: roads, waterreticulation, wastewater reticulation, stormwaternetworks and waste management◊ Infrastructure assets were last valued effective30 June <strong>2011</strong>.◊◊7,482 6,285 7,660 6,552Total assets under construction 12,789 9,815 13,090 11,272The fair value of infrastructure assets excludingland, was determined on an optimiseddepreciated replacement cost basis. Thevaluation was prepared by staff engineersemployed by PNCC (led by Eng Lim - BE, ME,MIPENZ, PGDipBusAdmin) and was carried outusing the New Zealand Infrastructure AssetValuation and Depreciation Guidelines producedby New Zealand Asset Management Steering(NAMS) Group. The valuation was reviewed byGraeme Hughson (BE, MIPENZ), a RegisteredEngineer from AECOM New Zealand Limited, whoconfirmed that the valuation basis is appropriatefor external reporting purposes.Infrastructure land (excluding land under roads)was last valued in <strong>2011</strong> on the basis of ‘openmarket value’ derived from sales evidenced for17 urban localties in <strong>Palmerston</strong> <strong>North</strong>, Ashhurstand Aokautere and one rate for rural area. Theopen market value was in turn discounted toprovide the specific rates for undeveloped land.While some infrastructure land (particularly offstreetparking land) has independent certificatesof title and therefore can be disposed of, the