2012 08 07 Undergraduate Catalog Cover - Lake Erie College

2012 08 07 Undergraduate Catalog Cover - Lake Erie College

2012 08 07 Undergraduate Catalog Cover - Lake Erie College

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

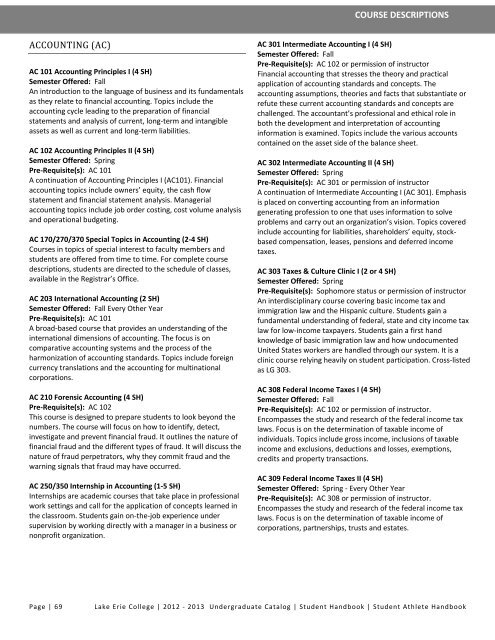

COURSE DESCRIPTIONSACCOUNTING (AC)AC 101 Accounting Principles I (4 SH)Semester Offered: FallAn introduction to the language of business and its fundamentalsas they relate to financial accounting. Topics include theaccounting cycle leading to the preparation of financialstatements and analysis of current, long-term and intangibleassets as well as current and long-term liabilities.AC 102 Accounting Principles II (4 SH)Semester Offered: SpringPre-Requisite(s): AC 101A continuation of Accounting Principles I (AC101). Financialaccounting topics include owners’ equity, the cash flowstatement and financial statement analysis. Managerialaccounting topics include job order costing, cost volume analysisand operational budgeting.AC 170/270/370 Special Topics in Accounting (2-4 SH)Courses in topics of special interest to faculty members andstudents are offered from time to time. For complete coursedescriptions, students are directed to the schedule of classes,available in the Registrar’s Office.AC 203 International Accounting (2 SH)Semester Offered: Fall Every Other YearPre-Requisite(s): AC 101A broad-based course that provides an understanding of theinternational dimensions of accounting. The focus is oncomparative accounting systems and the process of theharmonization of accounting standards. Topics include foreigncurrency translations and the accounting for multinationalcorporations.AC 210 Forensic Accounting (4 SH)Pre-Requisite(s): AC 102This course is designed to prepare students to look beyond thenumbers. The course will focus on how to identify, detect,investigate and prevent financial fraud. It outlines the nature offinancial fraud and the different types of fraud. It will discuss thenature of fraud perpetrators, why they commit fraud and thewarning signals that fraud may have occurred.AC 250/350 Internship in Accounting (1-5 SH)Internships are academic courses that take place in professionalwork settings and call for the application of concepts learned inthe classroom. Students gain on-the-job experience undersupervision by working directly with a manager in a business ornonprofit organization.AC 301 Intermediate Accounting I (4 SH)Semester Offered: FallPre-Requisite(s): AC 102 or permission of instructorFinancial accounting that stresses the theory and practicalapplication of accounting standards and concepts. Theaccounting assumptions, theories and facts that substantiate orrefute these current accounting standards and concepts arechallenged. The accountant’s professional and ethical role inboth the development and interpretation of accountinginformation is examined. Topics include the various accountscontained on the asset side of the balance sheet.AC 302 Intermediate Accounting II (4 SH)Semester Offered: SpringPre-Requisite(s): AC 301 or permission of instructorA continuation of Intermediate Accounting I (AC 301). Emphasisis placed on converting accounting from an informationgenerating profession to one that uses information to solveproblems and carry out an organization’s vision. Topics coveredinclude accounting for liabilities, shareholders’ equity, stockbasedcompensation, leases, pensions and deferred incometaxes.AC 303 Taxes & Culture Clinic I (2 or 4 SH)Semester Offered: SpringPre-Requisite(s): Sophomore status or permission of instructorAn interdisciplinary course covering basic income tax andimmigration law and the Hispanic culture. Students gain afundamental understanding of federal, state and city income taxlaw for low-income taxpayers. Students gain a first handknowledge of basic immigration law and how undocumentedUnited States workers are handled through our system. It is aclinic course relying heavily on student participation. Cross-listedas LG 303.AC 3<strong>08</strong> Federal Income Taxes I (4 SH)Semester Offered: FallPre-Requisite(s): AC 102 or permission of instructor.Encompasses the study and research of the federal income taxlaws. Focus is on the determination of taxable income ofindividuals. Topics include gross income, inclusions of taxableincome and exclusions, deductions and losses, exemptions,credits and property transactions.AC 309 Federal Income Taxes II (4 SH)Semester Offered: Spring - Every Other YearPre-Requisite(s): AC 3<strong>08</strong> or permission of instructor.Encompasses the study and research of the federal income taxlaws. Focus is on the determination of taxable income ofcorporations, partnerships, trusts and estates.Page | 69<strong>Lake</strong> <strong>Erie</strong> <strong>College</strong> | <strong>2012</strong> - 2013 <strong>Undergraduate</strong> <strong>Catalog</strong> | Student Handbook | Student Athlete Handbook