J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

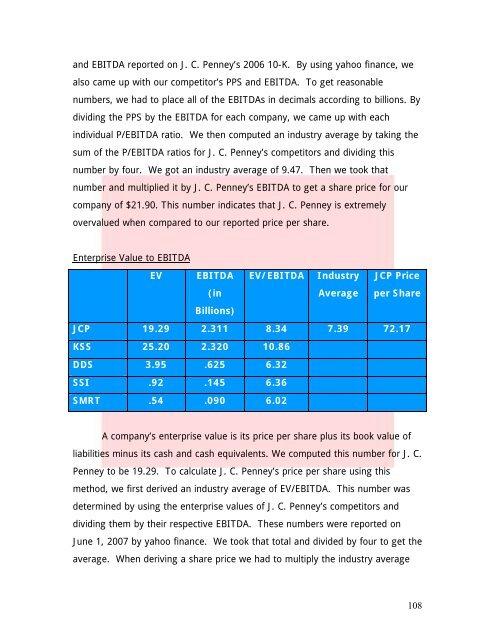

<strong>and</strong> EBITDA reported on J. C. <strong>Penney</strong>’s 2006 10-K. By using yahoo finance, wealso came up with our competitor’s PPS <strong>and</strong> EBITDA. To get reasonablenumbers, we had to place all <strong>of</strong> the EBITD<strong>As</strong> in decimals according to billions. Bydividing the PPS by the EBITDA for each company, we came up with eachindividual P/EBITDA ratio. We then computed an industry average by taking thesum <strong>of</strong> the P/EBITDA ratios for J. C. <strong>Penney</strong>’s competitors <strong>and</strong> dividing thisnumber by four. We got an industry average <strong>of</strong> 9.47. Then we took thatnumber <strong>and</strong> multiplied it by J. C. <strong>Penney</strong>’s EBITDA to get a share price for ourcompany <strong>of</strong> $21.90. This number indicates that J. C. <strong>Penney</strong> is extremelyovervalued when compared to our reported price per share.Enterprise Value to EBITDAEV EBITDA(inEV/EBITDA IndustryAverageJCP Priceper ShareBillions)JCP 19.29 2.311 8.34 7.39 72.17KSS 25.20 2.320 10.86DDS 3.95 .625 6.32SSI .92 .145 6.36SMRT .54 .090 6.02A company’s enterprise value is its price per share plus its book value <strong>of</strong>liabilities minus its cash <strong>and</strong> cash equivalents. We computed this number for J. C.<strong>Penney</strong> to be 19.29. To calculate J. C. <strong>Penney</strong>’s price per share using thismethod, we first derived an industry average <strong>of</strong> EV/EBITDA. This number wasdetermined by using the enterprise values <strong>of</strong> J. C. <strong>Penney</strong>’s competitors <strong>and</strong>dividing them by their respective EBITDA. These numbers were reported onJune 1, 2007 by yahoo finance. We took that total <strong>and</strong> divided by four to get theaverage. When deriving a share price we had to multiply the industry average108