J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

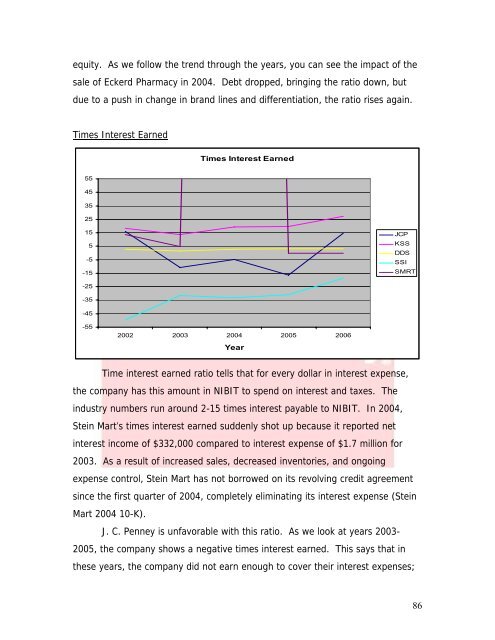

equity. <strong>As</strong> we follow the trend through the years, you can see the impact <strong>of</strong> thesale <strong>of</strong> Eckerd Pharmacy in 2004. Debt dropped, bringing the ratio down, butdue to a push in change in br<strong>and</strong> lines <strong>and</strong> differentiation, the ratio rises again.Times Interest EarnedTimes Interest Earned55453525155-5-15JCPKSSDDSSSISMRT-25-35-45-552002 2003 2004 2005 2006YearTime interest earned ratio tells that for every dollar in interest expense,the company has this amount in NIBIT to spend on interest <strong>and</strong> taxes. Theindustry numbers run around 2-15 times interest payable to NIBIT. In 2004,Stein Mart’s times interest earned suddenly shot up because it reported netinterest income <strong>of</strong> $332,000 compared to interest expense <strong>of</strong> $1.7 million for2003. <strong>As</strong> a result <strong>of</strong> increased sales, decreased inventories, <strong>and</strong> ongoingexpense control, Stein Mart has not borrowed on its revolving credit agreementsince the first quarter <strong>of</strong> 2004, completely eliminating its interest expense (SteinMart 2004 10-K).J. C. <strong>Penney</strong> is unfavorable with this ratio. <strong>As</strong> we look at years 2003-2005, the company shows a negative times interest earned. This says that inthese years, the company did not earn enough to cover their interest expenses;86