J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

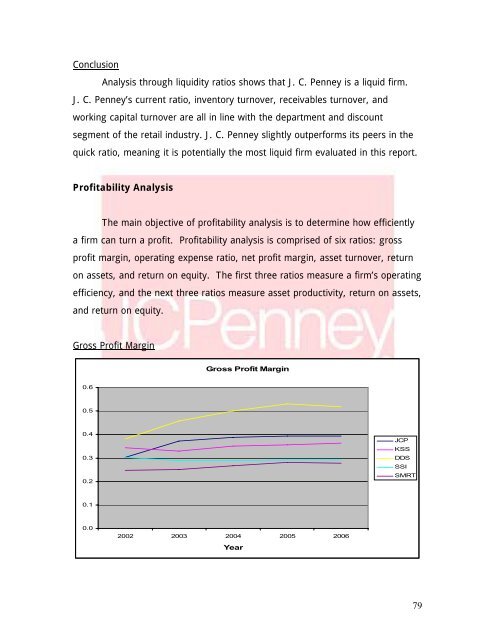

Conclusion<strong>Analysis</strong> through liquidity ratios shows that J. C. <strong>Penney</strong> is a liquid firm.J. C. <strong>Penney</strong>’s current ratio, inventory turnover, receivables turnover, <strong>and</strong>working capital turnover are all in line with the department <strong>and</strong> discountsegment <strong>of</strong> the retail industry. J. C. <strong>Penney</strong> slightly outperforms its peers in thequick ratio, meaning it is potentially the most liquid firm evaluated in this report.Pr<strong>of</strong>itability <strong>Analysis</strong>The main objective <strong>of</strong> pr<strong>of</strong>itability analysis is to determine how efficientlya firm can turn a pr<strong>of</strong>it. Pr<strong>of</strong>itability analysis is comprised <strong>of</strong> six ratios: grosspr<strong>of</strong>it margin, operating expense ratio, net pr<strong>of</strong>it margin, asset turnover, returnon assets, <strong>and</strong> return on equity. The first three ratios measure a firm’s operatingefficiency, <strong>and</strong> the next three ratios measure asset productivity, return on assets,<strong>and</strong> return on equity.Gross Pr<strong>of</strong>it MarginGross Pr<strong>of</strong>it Margin0.60.50.40.30.2JCPKSSDDSSSISMRT0.10.02002 2003 2004 2005 2006Year79