J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

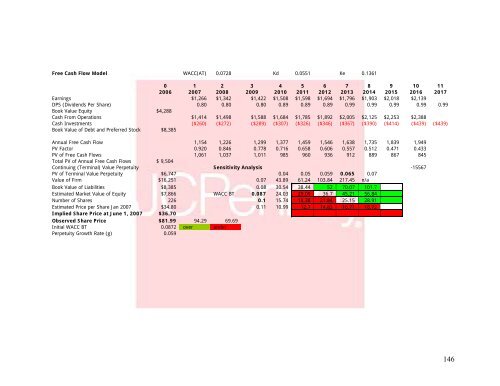

Free Cash Flow Model WACC(AT) 0.0728 Kd 0.0551 Ke 0.13610 1 2 3 4 5 6 7 8 9 10 112006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017Earnings $1,266 $1,342 $1,422 $1,508 $1,598 $1,694 $1,796 $1,903 $2,018 $2,139DPS (Dividends Per Share) 0.80 0.80 0.80 0.89 0.89 0.89 0.99 0.99 0.99 0.99 0.99Book Value <strong>Equity</strong> $4,288Cash From Operations $1,414 $1,498 $1,588 $1,684 $1,785 $1,892 $2,005 $2,125 $2,253 $2,388Cash Investments ($260) ($272) ($289) ($307) ($326) ($346) ($367) ($390) ($414) ($439) ($439)Book Value <strong>of</strong> Debt <strong>and</strong> Preferred Stock $8,385Annual Free Cash Flow 1,154 1,226 1,299 1,377 1,459 1,546 1,638 1,735 1,839 1,949PV Factor 0.920 0.846 0.778 0.716 0.658 0.606 0.557 0.512 0.471 0.433PV <strong>of</strong> Free Cash Flows 1,061 1,037 1,011 985 960 936 912 889 867 845Total PV <strong>of</strong> Annual Free Cash Flows $ 9,504Continuing (Terminal) Value Perpetuity Sensitivity <strong>Analysis</strong> -15567PV <strong>of</strong> Terminal Value Perpetuity $6,747 0.04 0.05 0.059 0.065 0.07Value <strong>of</strong> Firm $16,251 0.07 43.89 61.24 103.84 217.45 n/aBook Value <strong>of</strong> Liabilities $8,385 0.08 30.54 38.44 52 70.07 101.7Estimated Market Value <strong>of</strong> <strong>Equity</strong> $7,866 WACC BT 0.087 24.03 29.09 36.7 45.21 56.84Number <strong>of</strong> Shares 226 0.1 15.74 18.38 21.84 25.15 28.91Estimated Price per Share Jan 2007 $34.80 0.11 10.99 12.7 14.83 16.71 18.72Implied Share Price at June 1, 2007 $36.70Observed Share Price $81.99 94.29 69.69Initial WACC BT 0.0872 over underPerpetuity Growth Rate (g) 0.059146