- Page 1 and 2:

J. C. Penney Company, Inc. Equity V

- Page 5 and 6:

Industry AnalysisIn 1902, James Cas

- Page 7 and 8:

Financial Analysis, Forecast Financ

- Page 9 and 10:

Business & Industry AnalysisCompany

- Page 11 and 12:

Industry OverviewThe retail industr

- Page 13 and 14:

Five Forces ModelThe Five Forces Mo

- Page 15 and 16:

ConcentrationThe level of concentra

- Page 17 and 18:

capable of offering lower prices th

- Page 19 and 20:

If a firm wishes to shut down, it m

- Page 21 and 22:

Legal BarriersMany industries have

- Page 24 and 25:

These costs include issues such as

- Page 26 and 27:

Bargaining Power of SuppliersThe de

- Page 28 and 29:

The relative bargaining power of th

- Page 30 and 31:

Competitive StrategiesIn order to a

- Page 32 and 33:

Department stores have to focus on

- Page 34 and 35:

The Big PicturePlayers in this indu

- Page 36 and 37:

Lower Input CostsJ. C. Penney is at

- Page 38 and 39:

in the last five years. This trend

- Page 40 and 41:

convenient for different consumers

- Page 42 and 43:

transactions have been improperly s

- Page 44 and 45:

Penney does state in its annual rep

- Page 46 and 47:

Operating and Capital LeasesOperati

- Page 48 and 49:

Potential Accounting FlexibilityA f

- Page 50 and 51:

truly are. J. C. Penney, however, h

- Page 52 and 53:

Qualitative Analysis of DisclosureT

- Page 54 and 55:

we can see why targeting the strong

- Page 56 and 57:

manipulation diagnostics for J. C.

- Page 58 and 59:

Net Sales/Net Accounts ReceivableNe

- Page 60 and 61:

Net Sales/Unearned Revenue1200Net S

- Page 62 and 63:

Below is a chart of sales manipulat

- Page 64 and 65:

As for the industry, all the compan

- Page 66 and 67:

Pension Expense/SG&APension Expense

- Page 68 and 69:

Below is a chart of all expense man

- Page 70 and 71: discount rates in respect to pensio

- Page 72 and 73: Financial Analysis, Forecast Financ

- Page 74 and 75: paying off their short-term obligat

- Page 76 and 77: ecause many firms in this segment o

- Page 78 and 79: Penney’s inventory turnover is in

- Page 80 and 81: ConclusionAnalysis through liquidit

- Page 82 and 83: operating efficiency because the fi

- Page 84 and 85: Return on AssetsReturn on Assets0.1

- Page 86 and 87: Capital Structure AnalysisWhen look

- Page 88 and 89: however, in 2006, J. C. Penney show

- Page 90 and 91: Sustainable Growth RateSustainable

- Page 92 and 93: average of only years 2005 and 2006

- Page 94 and 95: (reported in millions)Annual Income

- Page 96 and 97: We then began to look at the equity

- Page 98 and 99: Common Size Balance Sheet 2002 2003

- Page 100 and 101: (numbers in millions)Statement of C

- Page 102 and 103: ConclusionOverall, it appears that

- Page 104 and 105: Inc. We set these averages equal to

- Page 106 and 107: Price to BookPPS BPS P/B IndustryAv

- Page 108 and 109: Price Earnings GrowthPPS EPS PEG In

- Page 110 and 111: y J. C. Penney’s EBITDA. Then we

- Page 112 and 113: Regression Analysis3 Month Rate 72

- Page 114 and 115: Intrinsic ValuationsIntrinsic valua

- Page 116 and 117: amount in the eye’s of shareholde

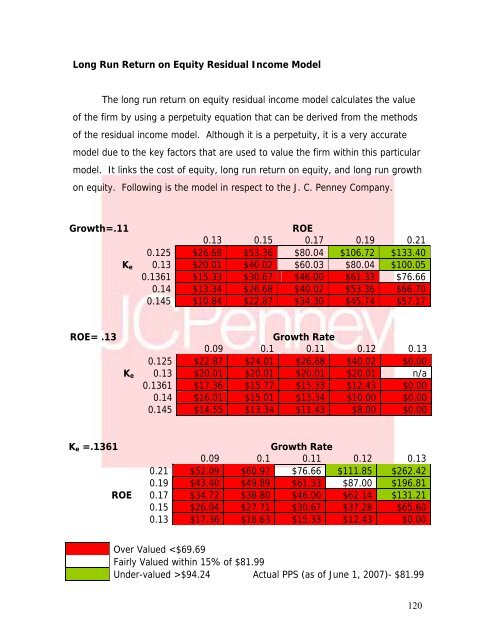

- Page 118 and 119: This particular stock price in our

- Page 122 and 123: To find our long run return on equi

- Page 124 and 125: Sensitivity AnalysisGrowth Rates0 -

- Page 126 and 127: for this large difference between s

- Page 128 and 129: Analyst RecommendationAfter careful

- Page 130 and 131: AppendixLiquidity RatiosCurrent rat

- Page 132 and 133: Capital Structure RatioDebt to equi

- Page 134 and 135: SUMMARY OUTPUT3 Month Regression72

- Page 136 and 137: SUMMARY OUTPUT6 Month Regression72

- Page 138 and 139: SUMMARY OUTPUT2 Year Regression72 M

- Page 140 and 141: SUMMARY OUTPUT5 Year Regression72 M

- Page 142 and 143: SUMMARY OUTPUT10 Year Regression72

- Page 144 and 145: Cost of Equity 0.1361Estimated Pric

- Page 146 and 147: Discount Dividends Model0 1 2 3 4 5

- Page 148 and 149: Residual Income Model WACC(AT) 0.07

- Page 150 and 151: Z-Score AnalysisZ-Score=1.21.43.320