J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

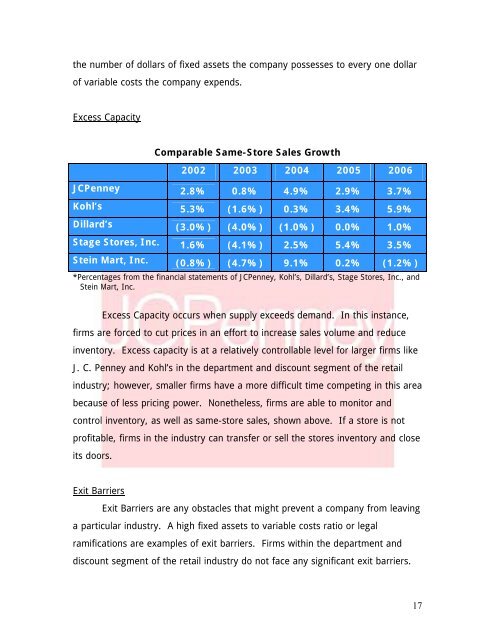

the number <strong>of</strong> dollars <strong>of</strong> fixed assets the company possesses to every one dollar<strong>of</strong> variable costs the company expends.Excess CapacityComparable Same-Store Sales Growth2002 2003 2004 2005 2006JC<strong>Penney</strong> 2.8% 0.8% 4.9% 2.9% 3.7%Kohl’s 5.3% (1.6%) 0.3% 3.4% 5.9%Dillard’s (3.0%) (4.0%) (1.0%) 0.0% 1.0%Stage Stores, <strong>Inc</strong>. 1.6% (4.1%) 2.5% 5.4% 3.5%Stein Mart, <strong>Inc</strong>. (0.8%) (4.7%) 9.1% 0.2% (1.2%)*Percentages from the financial statements <strong>of</strong> JC<strong>Penney</strong>, Kohl’s, Dillard’s, Stage Stores, <strong>Inc</strong>., <strong>and</strong>Stein Mart, <strong>Inc</strong>.Excess Capacity occurs when supply exceeds dem<strong>and</strong>. In this instance,firms are forced to cut prices in an effort to increase sales volume <strong>and</strong> reduceinventory. Excess capacity is at a relatively controllable level for larger firms likeJ. C. <strong>Penney</strong> <strong>and</strong> Kohl’s in the department <strong>and</strong> discount segment <strong>of</strong> the retailindustry; however, smaller firms have a more difficult time competing in this areabecause <strong>of</strong> less pricing power. Nonetheless, firms are able to monitor <strong>and</strong>control inventory, as well as same-store sales, shown above. If a store is notpr<strong>of</strong>itable, firms in the industry can transfer or sell the stores inventory <strong>and</strong> closeits doors.Exit BarriersExit Barriers are any obstacles that might prevent a company from leavinga particular industry. A high fixed assets to variable costs ratio or legalramifications are examples <strong>of</strong> exit barriers. Firms within the department <strong>and</strong>discount segment <strong>of</strong> the retail industry do not face any significant exit barriers.17