J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

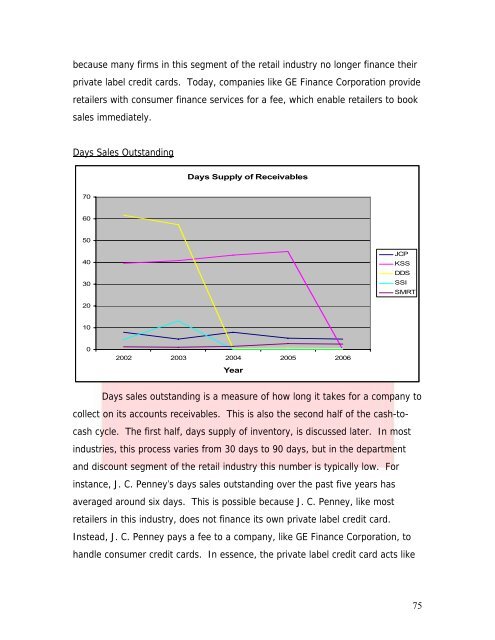

ecause many firms in this segment <strong>of</strong> the retail industry no longer finance theirprivate label credit cards. Today, companies like GE Finance Corporation provideretailers with consumer finance services for a fee, which enable retailers to booksales immediately.Days Sales Outst<strong>and</strong>ingDays Supply <strong>of</strong> Receivables7060504030JCPKSSDDSSSISMRT201002002 2003 2004 2005 2006YearDays sales outst<strong>and</strong>ing is a measure <strong>of</strong> how long it takes for a company tocollect on its accounts receivables. This is also the second half <strong>of</strong> the cash-tocashcycle. The first half, days supply <strong>of</strong> inventory, is discussed later. In mostindustries, this process varies from 30 days to 90 days, but in the department<strong>and</strong> discount segment <strong>of</strong> the retail industry this number is typically low. Forinstance, J. C. <strong>Penney</strong>’s days sales outst<strong>and</strong>ing over the past five years hasaveraged around six days. This is possible because J. C. <strong>Penney</strong>, like mostretailers in this industry, does not finance its own private label credit card.Instead, J. C. <strong>Penney</strong> pays a fee to a company, like GE Finance Corporation, toh<strong>and</strong>le consumer credit cards. In essence, the private label credit card acts like75