J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

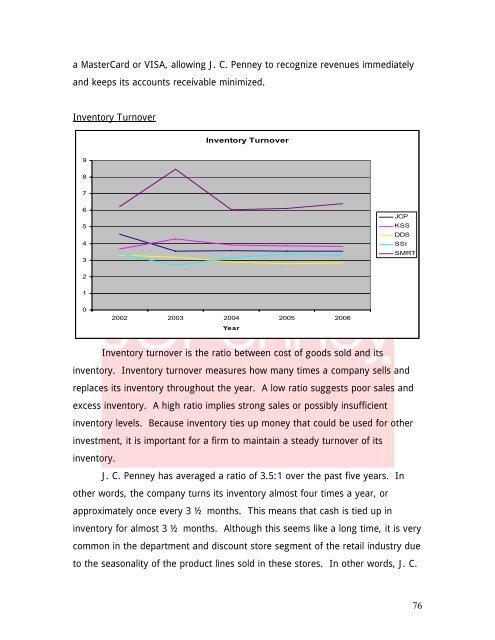

a MasterCard or VISA, allowing J. C. <strong>Penney</strong> to recognize revenues immediately<strong>and</strong> keeps its accounts receivable minimized.Inventory TurnoverInventory Turnover9876543JCPKSSDDSSSISMRT2102002 2003 2004 2005 2006YearInventory turnover is the ratio between cost <strong>of</strong> goods sold <strong>and</strong> itsinventory. Inventory turnover measures how many times a company sells <strong>and</strong>replaces its inventory throughout the year. A low ratio suggests poor sales <strong>and</strong>excess inventory. A high ratio implies strong sales or possibly insufficientinventory levels. Because inventory ties up money that could be used for otherinvestment, it is important for a firm to maintain a steady turnover <strong>of</strong> itsinventory.J. C. <strong>Penney</strong> has averaged a ratio <strong>of</strong> 3.5:1 over the past five years. Inother words, the company turns its inventory almost four times a year, orapproximately once every 3 ½ months. This means that cash is tied up ininventory for almost 3 ½ months. Although this seems like a long time, it is verycommon in the department <strong>and</strong> discount store segment <strong>of</strong> the retail industry dueto the seasonality <strong>of</strong> the product lines sold in these stores. In other words, J. C.76