J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

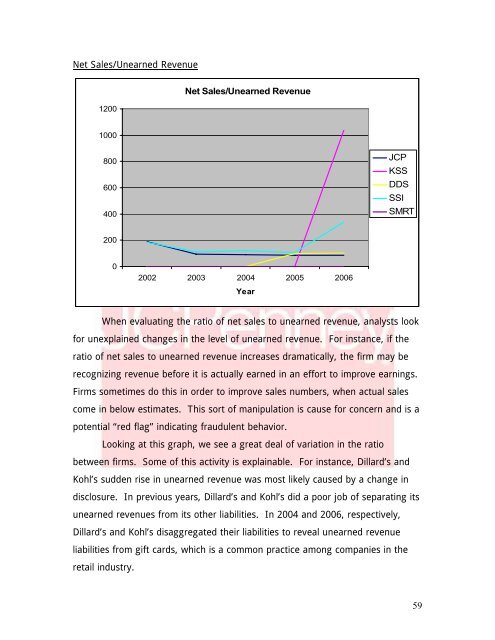

Net Sales/Unearned Revenue1200Net Sales/Unearned Revenue1000800600400JCPKSSDDSSSISMRT20002002 2003 2004 2005 2006YearWhen evaluating the ratio <strong>of</strong> net sales to unearned revenue, analysts lookfor unexplained changes in the level <strong>of</strong> unearned revenue. For instance, if theratio <strong>of</strong> net sales to unearned revenue increases dramatically, the firm may berecognizing revenue before it is actually earned in an effort to improve earnings.Firms sometimes do this in order to improve sales numbers, when actual salescome in below estimates. This sort <strong>of</strong> manipulation is cause for concern <strong>and</strong> is apotential “red flag” indicating fraudulent behavior.Looking at this graph, we see a great deal <strong>of</strong> variation in the ratiobetween firms. Some <strong>of</strong> this activity is explainable. For instance, Dillard’s <strong>and</strong>Kohl’s sudden rise in unearned revenue was most likely caused by a change indisclosure. In previous years, Dillard’s <strong>and</strong> Kohl’s did a poor job <strong>of</strong> separating itsunearned revenues from its other liabilities. In 2004 <strong>and</strong> 2006, respectively,Dillard’s <strong>and</strong> Kohl’s disaggregated their liabilities to reveal unearned revenueliabilities from gift cards, which is a common practice among companies in theretail industry.59