J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

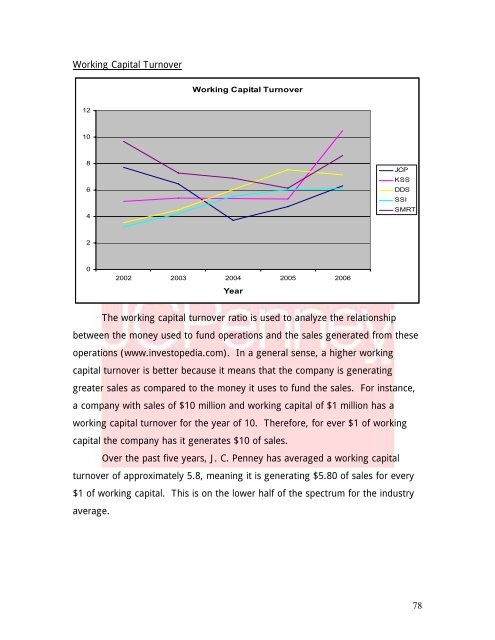

Working Capital TurnoverWorking Capital Turnover1210864JCPKSSDDSSSISMRT202002 2003 2004 2005 2006YearThe working capital turnover ratio is used to analyze the relationshipbetween the money used to fund operations <strong>and</strong> the sales generated from theseoperations (www.investopedia.com). In a general sense, a higher workingcapital turnover is better because it means that the company is generatinggreater sales as compared to the money it uses to fund the sales. For instance,a company with sales <strong>of</strong> $10 million <strong>and</strong> working capital <strong>of</strong> $1 million has aworking capital turnover for the year <strong>of</strong> 10. Therefore, for ever $1 <strong>of</strong> workingcapital the company has it generates $10 <strong>of</strong> sales.Over the past five years, J. C. <strong>Penney</strong> has averaged a working capitalturnover <strong>of</strong> approximately 5.8, meaning it is generating $5.80 <strong>of</strong> sales for every$1 <strong>of</strong> working capital. This is on the lower half <strong>of</strong> the spectrum for the industryaverage.78