J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

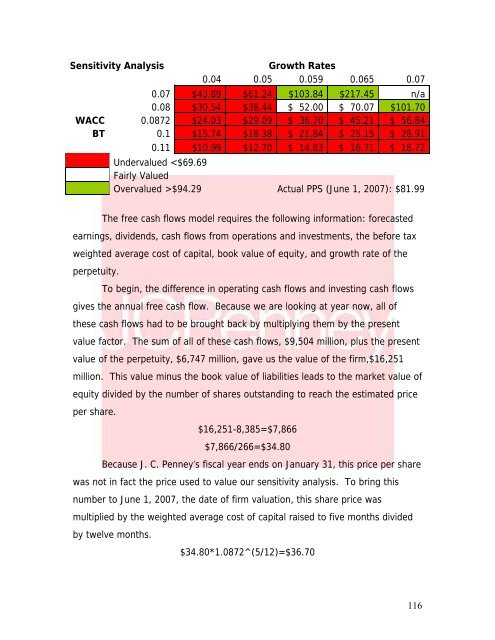

Sensitivity <strong>Analysis</strong>Growth Rates0.04 0.05 0.059 0.065 0.070.07 $43.89 $61.24 $103.84 $217.45 n/a0.08 $30.54 $38.44 $ 52.00 $ 70.07 $101.70WACC 0.0872 $24.03 $29.09 $ 36.70 $ 45.21 $ 56.84BT 0.1 $15.74 $18.38 $ 21.84 $ 25.15 $ 28.910.11 $10.99 $12.70 $ 14.83 $ 16.71 $ 18.72Undervalued $94.29 Actual PPS (June 1, 2007): $81.99The free cash flows model requires the following information: forecastedearnings, dividends, cash flows from operations <strong>and</strong> investments, the before taxweighted average cost <strong>of</strong> capital, book value <strong>of</strong> equity, <strong>and</strong> growth rate <strong>of</strong> theperpetuity.To begin, the difference in operating cash flows <strong>and</strong> investing cash flowsgives the annual free cash flow. Because we are looking at year now, all <strong>of</strong>these cash flows had to be brought back by multiplying them by the presentvalue factor. The sum <strong>of</strong> all <strong>of</strong> these cash flows, $9,504 million, plus the presentvalue <strong>of</strong> the perpetuity, $6,747 million, gave us the value <strong>of</strong> the firm,$16,251million. This value minus the book value <strong>of</strong> liabilities leads to the market value <strong>of</strong>equity divided by the number <strong>of</strong> shares outst<strong>and</strong>ing to reach the estimated priceper share.$16,251-8,385=$7,866$7,866/266=$34.80Because J. C. <strong>Penney</strong>’s fiscal year ends on January 31, this price per sharewas not in fact the price used to value our sensitivity analysis. To bring thisnumber to June 1, 2007, the date <strong>of</strong> firm valuation, this share price wasmultiplied by the weighted average cost <strong>of</strong> capital raised to five months dividedby twelve months.$34.80*1.0872^(5/12)=$36.70116