J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

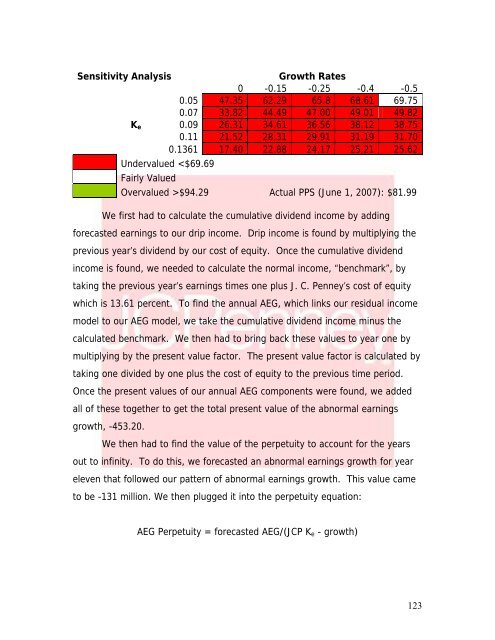

Sensitivity <strong>Analysis</strong>Growth Rates0 -0.15 -0.25 -0.4 -0.50.05 47.35 62.29 65.8 68.61 69.750.07 33.82 44.49 47.00 49.01 49.82K e 0.09 26.31 34.61 36.56 38.12 38.750.11 21.52 28.31 29.91 31.19 31.700.1361 17.40 22.88 24.17 25.21 25.62Undervalued $94.29 Actual PPS (June 1, 2007): $81.99We first had to calculate the cumulative dividend income by addingforecasted earnings to our drip income. Drip income is found by multiplying theprevious year’s dividend by our cost <strong>of</strong> equity. Once the cumulative dividendincome is found, we needed to calculate the normal income, “benchmark”, bytaking the previous year’s earnings times one plus J. C. <strong>Penney</strong>’s cost <strong>of</strong> equitywhich is 13.61 percent. To find the annual AEG, which links our residual incomemodel to our AEG model, we take the cumulative dividend income minus thecalculated benchmark. We then had to bring back these values to year one bymultiplying by the present value factor. The present value factor is calculated bytaking one divided by one plus the cost <strong>of</strong> equity to the previous time period.Once the present values <strong>of</strong> our annual AEG components were found, we addedall <strong>of</strong> these together to get the total present value <strong>of</strong> the abnormal earningsgrowth, -453.20.We then had to find the value <strong>of</strong> the perpetuity to account for the yearsout to infinity. To do this, we forecasted an abnormal earnings growth for yeareleven that followed our pattern <strong>of</strong> abnormal earnings growth. This value cameto be -131 million. We then plugged it into the perpetuity equation:AEG Perpetuity = forecasted AEG/(JCP K e - growth)123