J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

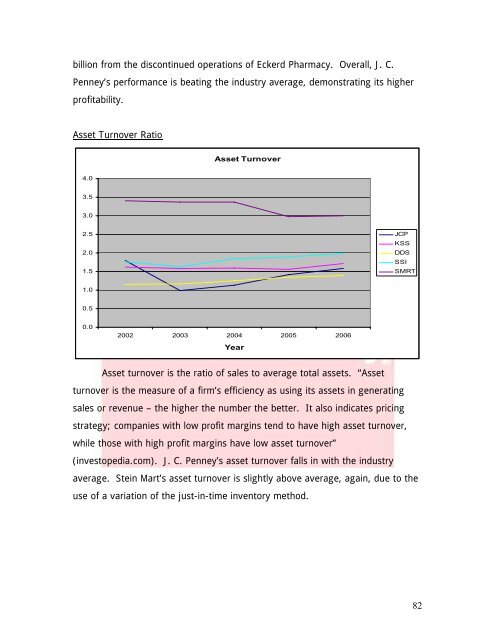

illion from the discontinued operations <strong>of</strong> Eckerd Pharmacy. Overall, J. C.<strong>Penney</strong>’s performance is beating the industry average, demonstrating its higherpr<strong>of</strong>itability.<strong>As</strong>set Turnover Ratio<strong>As</strong>set Turnover4.03.53.02.52.01.5JCPKSSDDSSSISMRT1.00.50.02002 2003 2004 2005 2006Year<strong>As</strong>set turnover is the ratio <strong>of</strong> sales to average total assets. “<strong>As</strong>setturnover is the measure <strong>of</strong> a firm’s efficiency as using its assets in generatingsales or revenue – the higher the number the better. It also indicates pricingstrategy; companies with low pr<strong>of</strong>it margins tend to have high asset turnover,while those with high pr<strong>of</strong>it margins have low asset turnover”(investopedia.com). J. C. <strong>Penney</strong>’s asset turnover falls in with the industryaverage. Stein Mart’s asset turnover is slightly above average, again, due to theuse <strong>of</strong> a variation <strong>of</strong> the just-in-time inventory method.82