J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

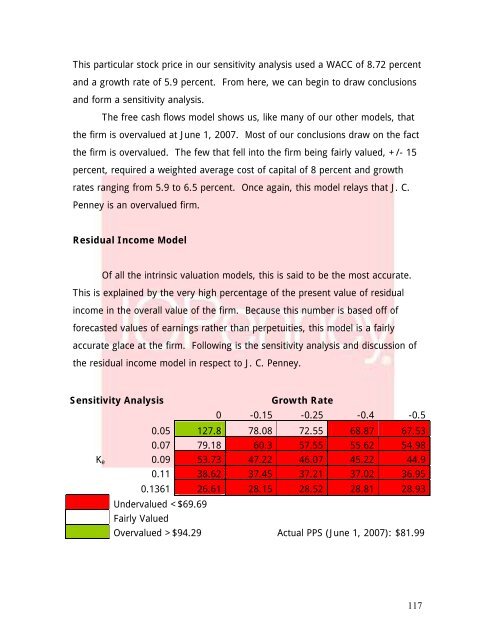

This particular stock price in our sensitivity analysis used a WACC <strong>of</strong> 8.72 percent<strong>and</strong> a growth rate <strong>of</strong> 5.9 percent. From here, we can begin to draw conclusions<strong>and</strong> form a sensitivity analysis.The free cash flows model shows us, like many <strong>of</strong> our other models, thatthe firm is overvalued at June 1, 2007. Most <strong>of</strong> our conclusions draw on the factthe firm is overvalued. The few that fell into the firm being fairly valued, +/- 15percent, required a weighted average cost <strong>of</strong> capital <strong>of</strong> 8 percent <strong>and</strong> growthrates ranging from 5.9 to 6.5 percent. Once again, this model relays that J. C.<strong>Penney</strong> is an overvalued firm.Residual <strong>Inc</strong>ome ModelOf all the intrinsic valuation models, this is said to be the most accurate.This is explained by the very high percentage <strong>of</strong> the present value <strong>of</strong> residualincome in the overall value <strong>of</strong> the firm. Because this number is based <strong>of</strong>f <strong>of</strong>forecasted values <strong>of</strong> earnings rather than perpetuities, this model is a fairlyaccurate glace at the firm. Following is the sensitivity analysis <strong>and</strong> discussion <strong>of</strong>the residual income model in respect to J. C. <strong>Penney</strong>.Sensitivity <strong>Analysis</strong>Growth Rate0 -0.15 -0.25 -0.4 -0.50.05 127.8 78.08 72.55 68.87 67.530.07 79.18 60.3 57.55 55.62 54.98K e 0.09 53.73 47.22 46.07 45.22 44.90.11 38.62 37.45 37.21 37.02 36.950.1361 26.61 28.15 28.52 28.81 28.93Undervalued $94.29 Actual PPS (June 1, 2007): $81.99117