J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

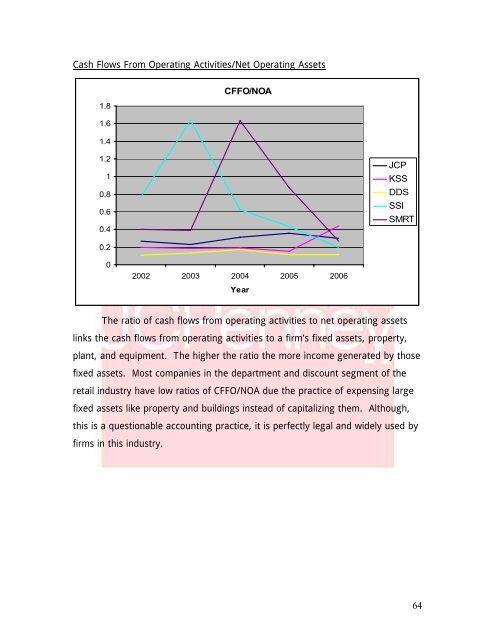

Cash Flows From Operating Activities/Net Operating <strong>As</strong>setsCFFO/NOA1.81.61.41.210.80.60.4JCPKSSDDSSSISMRT0.202002 2003 2004 2005 2006YearThe ratio <strong>of</strong> cash flows from operating activities to net operating assetslinks the cash flows from operating activities to a firm’s fixed assets, property,plant, <strong>and</strong> equipment. The higher the ratio the more income generated by thosefixed assets. Most companies in the department <strong>and</strong> discount segment <strong>of</strong> theretail industry have low ratios <strong>of</strong> CFFO/NOA due the practice <strong>of</strong> expensing largefixed assets like property <strong>and</strong> buildings instead <strong>of</strong> capitalizing them. Although,this is a questionable accounting practice, it is perfectly legal <strong>and</strong> widely used byfirms in this industry.64