J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

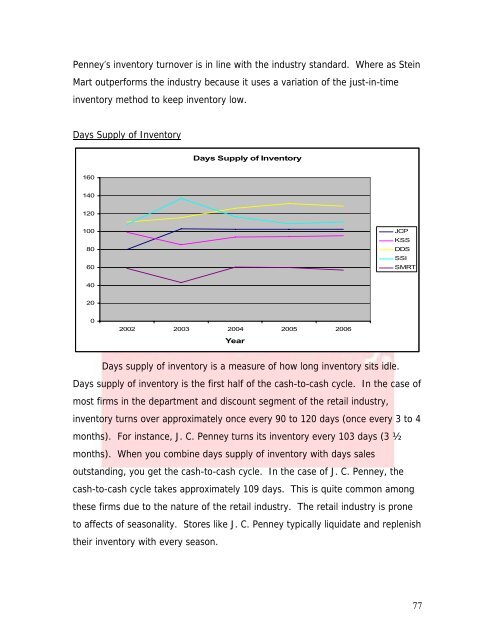

<strong>Penney</strong>’s inventory turnover is in line with the industry st<strong>and</strong>ard. Where as SteinMart outperforms the industry because it uses a variation <strong>of</strong> the just-in-timeinventory method to keep inventory low.Days Supply <strong>of</strong> InventoryDays Supply <strong>of</strong> Inventory1601401201008060JCPKSSDDSSSISMRT402002002 2003 2004 2005 2006YearDays supply <strong>of</strong> inventory is a measure <strong>of</strong> how long inventory sits idle.Days supply <strong>of</strong> inventory is the first half <strong>of</strong> the cash-to-cash cycle. In the case <strong>of</strong>most firms in the department <strong>and</strong> discount segment <strong>of</strong> the retail industry,inventory turns over approximately once every 90 to 120 days (once every 3 to 4months). For instance, J. C. <strong>Penney</strong> turns its inventory every 103 days (3 ½months). When you combine days supply <strong>of</strong> inventory with days salesoutst<strong>and</strong>ing, you get the cash-to-cash cycle. In the case <strong>of</strong> J. C. <strong>Penney</strong>, thecash-to-cash cycle takes approximately 109 days. This is quite common amongthese firms due to the nature <strong>of</strong> the retail industry. The retail industry is proneto affects <strong>of</strong> seasonality. Stores like J. C. <strong>Penney</strong> typically liquidate <strong>and</strong> replenishtheir inventory with every season.77